What are the reserves used for?

Singapore's reserves support crisis spending, contribute to public spending, back CPF interest rates and finance land projects.

On this page

Reserves provide support in times of crisis

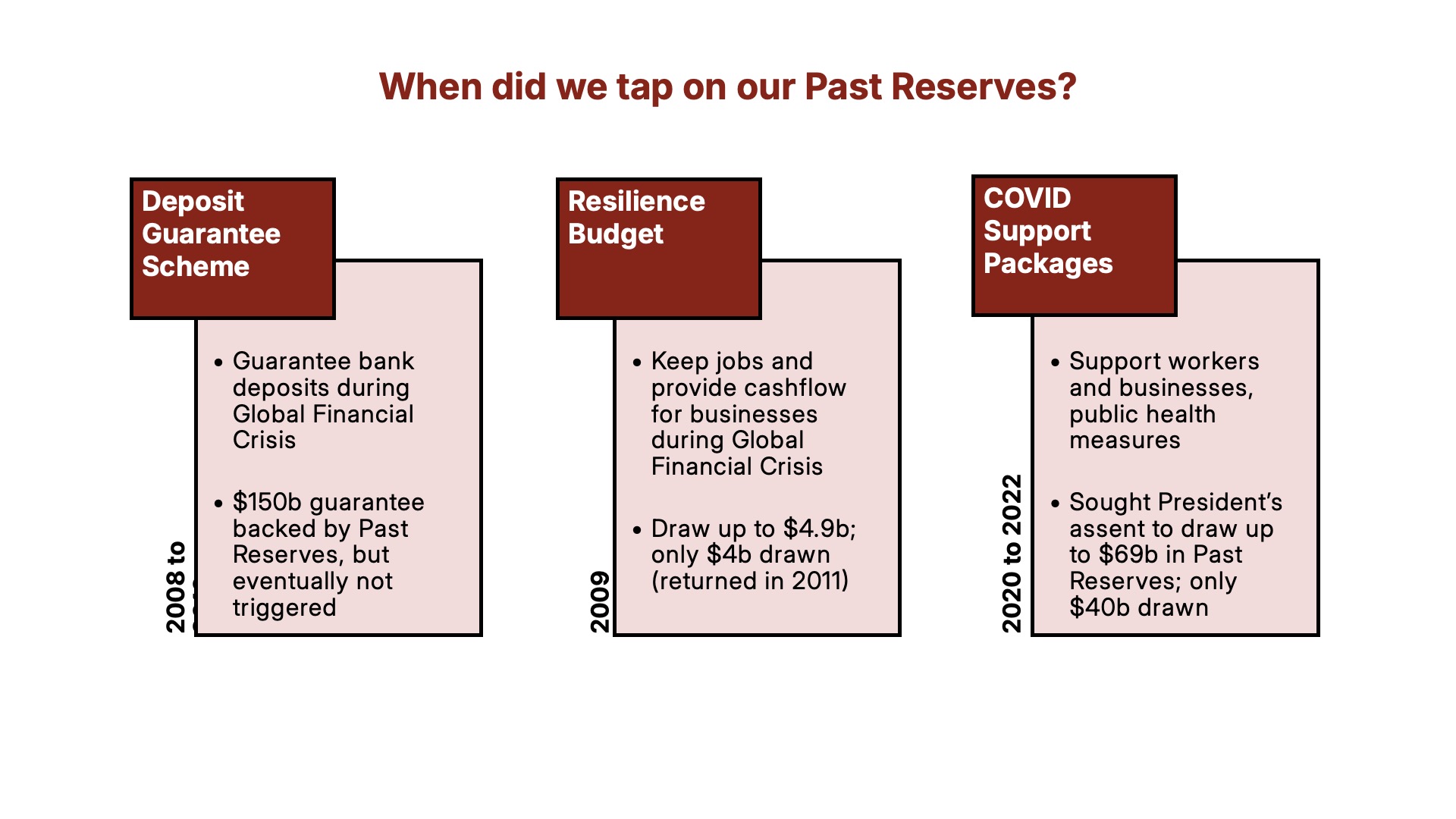

The reserves ensure that Singapore can respond decisively during crises without compromising essential services and incurring debt for future generations. For example:

During the Global Financial Crisis, we drew on Past Reserves to subsidise employees' wage bills and improve companies' access to credit.

In our fight against COVID-19, the Government drew about $40 billion from Past Reserves for COVID-19 response measures across FY2020 to FY2022. By drawing on the reserves, the Government was able to fund public health measures as well as economic and social support measures, to save lives and protect livelihoods.

The ability to use our reserves in a sustainable manner is a significant financial advantage for Singapore. Our situation is quite unlike that in many countries where they have to service their debts and other liabilities from their budgets on an annual basis, and consequently either raise taxes or engage in further borrowings to service current borrowings.

Watch this CNA documentary for a first-hand account of the decision-making process behind the two rare occasions that the Singapore government tapped on Past Reserves.

![Thumbnail for [Online Special] ‘President, we have a problem’ - Pt 4/5 | Singapore Reserves Revealed](https://i.ytimg.com/vi/fRkFzeJ5mbE/hqdefault.jpg)

Will the Government return the $40 billion drawn from the Past Reserves during the COVID-19 pandemic?

Between FY2020 and FY2022, Singapore drew about $40 billion from the Past Reserves to support COVID-19 measures to safeguard Singaporeans’ lives and livelihoods during the crisis.

We do not expect to be able to put back the amount drawn from the Past Reserves during COVID-19. As previously explained by the Prime Minister in the debate on the Budget Statement 2025, this is because we expect our spending to increase in the coming years, and we will have to deploy our fiscal resources to meet this increased expenditure in order to keep within our means and maintain a balanced Budget over the medium term.

We will nevertheless continue to be responsible and prudent with our finances, and any surpluses accumulated at the end of the term of Government will be protected as Past Reserves.

Reserves contribute to public spending

The reserves support Singapore’s current spending needs through its contribution to the annual Budget. About 20% of annual Government spending is funded by the investment returns on our reserves through the Net Investment Returns Contribution (NIRC). The estimated NIRC for FY2026 is $28.48 billion.

The investment returns from our reserves provide additional resources for Government spending to benefit Singaporeans. This includes Government investments in education, healthcare, transport infrastructure, R&D and other areas to improve our living environment and to grow our economy.

Today, the NIRC is one of Singapore’s largest sources of Government revenue for annual spending. There have been calls to increase the NIRC above the present spending limit of 50% of the expected long-term real rate of return on the Relevant Assets , but there are trade-offs that we would have to weigh. The few other countries where Governments are able to derive a revenue stream for public spending are typically those with substantial reserves of natural resources such as oil.

The current framework balances between the needs of today and tomorrow. It underscores the Government’s commitment to continue growing our reserves for future generations, while allowing the Government to tap on part of the investment income for current spending.

If we spend more from NIRC today, we would effectively be reducing the reserves available for future use, which might result in higher taxes in the future or reduced expenditure for our future needs.

Reserves serve as a financial anchor

As Singapore is a small and highly open economy, inflation and aggregate demand are more significantly influenced by the exchange rate rather than interest rates. Singapore’s monetary policy framework, conducted by MAS, is thus centred on managing the exchange rate of the Singapore Dollar against a basket of currencies within a policy band.

The reserves enable MAS to conduct monetary policy and secure macroeconomic stability, by defending the value of the Singapore Dollar from major fluctuations. This helps to protect the purchasing power of Singaporean households and businesses, maintain investor confidence in Singapore’s exchange rate-centred financial system, and secure macroeconomic stability.

Understand more

Net Investment Returns Contribution

The Net Investment Returns Contribution is the investment income of Singapore’s Past Reserves taken in for Government spending, and a key source of our revenue.

Why we do we grow our reserves?

While our reserves are growing, the size of our economy, the challenges facing our economy and complexity of our needs are growing even faster.

Reserves hold our Land Bank

Land is scarce in Singapore, and it is our main natural resource. It is thus protected as part of our Past Reserves.

Our Past Reserves are used to fund land-related projects such as land reclamation and the creation of underground space1 like the Jurong Rock Cavern, as well as specific land acquisition projects like Selective En-bloc Redevelopment Scheme (SERS)2. These are forms of asset conversion, from a financial asset to a physical asset. The land created or acquired forms part of our State land holdings and is protected as Past Reserves. Further, when such land is subsequently sold, the proceeds accrue fully to Past Reserves to ensure that there is no draw on Past Reserves.

[1] Past Reserves are used to fund only expenditure directly related to the creation of land, but not for the construction of infrastructure on the land.

[2] Past Reserves are used to fund only the land component of the total compensation of the acquisition costs.

Spending from Land Sale Proceeds

As the State holds ultimate title to the land, land which returns to the State at the end of a lease becomes State land once again and is protected as part of the Past Reserves.

When that happens, there is no net increase in the reserves. This is because the value of the “reversionary interest” in land (i.e. the right to resume ownership of the land at the end of a lease) is already protected as Past Reserves.

In other words, when land is sold, the financial proceeds that the State receives make up for the State's loss of use of the land for the lease period, and not for the State giving the land away forever.

Spending the proceeds from selling land directly is akin to using Past Reserves. If the Government relies on land sales to fund spending, given that land prices move in cycles and can be volatile, this would cause Government revenues to fluctuate with the market, creating too much uncertainty for the Government to plan for the long term. Additionally, the Government could develop a vested interest in keeping land prices high to maximise revenues.

Instead, the Government’s approach is to invest the land sales proceeds with the rest of the reserves, and spend up to 50% of the returns through the NIRC framework. This approach provides a more stable and sustainable stream of income over time than directly spending the land sales proceeds.

When is State land considered disposed of?

State land forms part of the Government’s Past Reserves. State land is disposed of (or sold) when the Government issues freehold titles, or leasehold titles of 10 years or more. As the disposal of State land is merely a conversion from a physical asset to a financial asset, the proceeds from the disposal of State land accrue to Past Reserves.

State land is not considered disposed of when the Government issues leasehold titles of a total period of less than 10 years.

Why is it important for State land to be sold at fair market value?

The fair market value of an asset is the price that it would sell for in a free and open market, between a willing buyer and willing seller. For State land, the fair market value can be determined by open tender, or by professional valuation.

In the case of land used for public housing, the value is determined professionally and independently by the Chief Valuer, using established valuation principles.

When the Government uses State land (which forms part of the reserves) for development, including for public housing, the fair market value of the land must be paid into the reserves, to preserve the value of the reserves. Selling land at below fair market value, or at no cost, would erode our reserves.

For more information on land valuation and public housing policies, please refer to MND’s resources.

Reserves guarantee CPF interest rates

CPF monies are invested by the CPF Board (CPFB) in Special Singapore Government Securities (SSGS) that are issued and guaranteed by the Singapore Government. This arrangement assures that CPFB will be able to pay its members all their monies when due, and the interest that it commits to pay on CPF accounts.

This is a solid guarantee. The Singapore Government is one of the few remaining triple-A credit-rated governments in the world. To elaborate:

The Government is in a strong net asset position, i.e. its assets far exceed its liabilities (CPF liabilities in the form of SSGS are a part of these liabilities). The strong net asset position can be seen from the NIRC that is available for spending on the Government Budget. Over the past five years, the NIRC has provided an average revenue stream of about 3.5% of GDP per annum.

What this means is that even after deducting all the Government's liabilities, the remaining net assets produce significant returns. The NIRC is drawn from returns on assets in excess of the liabilities, and not the returns on gross assets. The NIRC figures are submitted to the President's Office and audited by the Auditor-General's Office.

If the Government's assets had not been adequate to meet its liabilities, there would have been no contribution from the investment returns on reserves in the Government Budget.

No CPF monies go towards government spending. Government borrowings from Singapore Government Securities (SGS) and SSGS cannot be used to fund expenditures. Under the Government Securities Act (enacted in 1992), the monies raised from SGS and SSGS cannot be spent.

These funds are commingled together with other sources of government funds (e.g., unencumbered assets3 such as government surpluses and land sales receipts) and deposited with MAS as government deposits.

[3] Unencumbered assets refer to assets which are not matched to any liabilities. The Government has large, unencumbered assets, which are not matched to liabilities. These assets were accumulated through past government surpluses, land sales receipts and the investment income earned on those assets over the years.

This CNA documentary explains how Singapore’s reserves guarantee CPF interest rates.

![Thumbnail for [Online Special] Why are our reserves a secret weapon? - Pt 5/5 | Singapore Reserves Revealed](https://i.ytimg.com/vi/gt4XmU5xkP4/hqdefault.jpg)

Understand more

Which investment entity invests CPF monies?

The Government’s assets are mainly managed by GIC. GIC is a fund manager, not the owner of the assets. It receives funds from Government for long-term management, without regard to the sources of Government funds, e.g. SGS, SSGS, government surpluses. The Government’s mandate to GIC is to manage the assets in a single pool, on an unencumbered basis5, with the aim of achieving good long-term returns. This allows GIC to take calculated investment risks aimed at achieving good long-term returns, without regard to the Government’s specific liabilities.

GIC’s long-term returns are thus not earned by managing only SSGS proceeds, but the combined pool of Government funds. If GIC were to manage SSGS proceeds directly through a separate, standalone fund, without the backing of the Government’s net assets, it would invest more conservatively, to avoid the risk of failing to meet obligations to CPF members – including not only a capital guarantee but the commitment to pay the minimum interest rates on CPF monies, regardless of market conditions. The fund would not be aimed at accepting risks that enable good long-term returns, but at avoiding any short-term shortfalls. The returns that such a fund would earn over the long term would be lower than what the GIC could expect to achieve with its current mandate of managing the Government’s pooled assets on an unencumbered basis.

Are MAS and Temasek involved?

Prior to the formation of GIC, it was the MAS that managed the Government’s assets (e.g. Government surpluses) as the central bank. The investment of the assets was in keeping with the traditional approach of central banks, with large allocations to liquid, low-risk instruments. After GIC was formed in 1981, the assets were progressively transferred from MAS to GIC for management. This was to enable the assets to be invested in higher-risk instruments that could be expected to earn higher returns over the long term.

Temasek has never managed the SSGS proceeds or any CPF monies. Temasek manages its own assets, which have accrued mainly from proceeds from sale of its investments and reinvestments of dividends and other cash distributions it receives from its portfolio companies and other investments. Temasek also has its own borrowings and debt financing sources. The Government’s relationship with Temasek is that of its sole equity shareholder.

How are CPF interest rates determined?

CPF interest rates are pegged to the returns on market instruments of comparable risk and duration.

However, there is also a minimum interest rate on CPF savings that protects members from downside market volatility risks, such as over the past two decades. The computation approach for the CPF Ordinary, Special, MediSave and Retirement Accounts' interest rates and the applicable minimum interest rates are listed below.

Ordinary Account (OA): Computed based on the 3-month average of major local banks' interest rates, subject to the legislated minimum interest rate of 2.5% per annum. More information can be found on CPF website.

Special, MediSave and Retirement Accounts (SMRA): Computed based on the 12-month average yield of 10-year SGS plus 1%, subject to the current floor interest rate of 4% per annum.

The SMRA are for longer-term retirement and medical needs. To provide certainty for CPF members amidst an uncertain interest rate environment, the Government has extended the 4% floor rate for interest earned on all SMRA savings since it was first introduced in 2008.

The interest rate on the SMRA aims to be equivalent to what a 30-year SGS would earn, as 30 years is the typical duration for which SMRA monies are held. As the 30-year SGS did not exist when the Government made changes to the interest rate structure in 2007, SMRA rates were pegged to the yield of 10-year SGS plus 1%.

In addition, CPF members below age 55 earn an extra 1% interest on the first $60,000 of their combined CPF balances (capped at $20,000 for OA), while members aged 55 and above earn an extra 2% interest on the first $30,000 of their combined balances (capped at $20,000 for OA), and an extra 1% interest on the next $30,000.

There is no link between CPF interest rates and the returns earned by GIC. The CPF Board invests CPF savings entirely in risk-free SSGS issued by the Government.

The Government invests the SSGS proceeds together with its other assets through the GIC, which takes investment risks aimed at achieving good long-term returns. However, the consequence of taking risk as a long-term investor is that returns may be weak or even negative over shorter periods. Yet, the Government is able to guarantee CPF savings and pay the minimum interest rates on CPF savings regardless of GIC's returns over any period, because the Government's balance sheet enables it to absorb risks. The Government has a significant buffer of net assets, i.e. assets which are well above its liabilities, including its CPF commitments.

For example, GIC experienced losses in investment value during the Global Financial Crisis, and low average returns for five years, before recovering (see GIC's annual report).

The Government was able to bear this investment risk and meet its obligations because of its substantial buffer of net assets .

This also means that GIC can invest without regard to the Government's specific liabilities. This enables GIC to focus on achieving good long-term returns, in full knowledge that the portfolio will be exposed to significant risks over the shorter term as the markets experience cycles and volatility. These risks are absorbed by the Government's balance sheet.

More Resources: