Who manages the reserves?

Learn about the entities managing our reserves: MAS, GIC and Temasek.

On this page

What is the role of the Government in managing the reserves?

Given its strategic importance, it is vital that we enhance the value of our reserves over the longer term. To achieve this, the assets are invested professionally and on a strictly commercial basis, with the aim of generating sustainable returns over the long term.

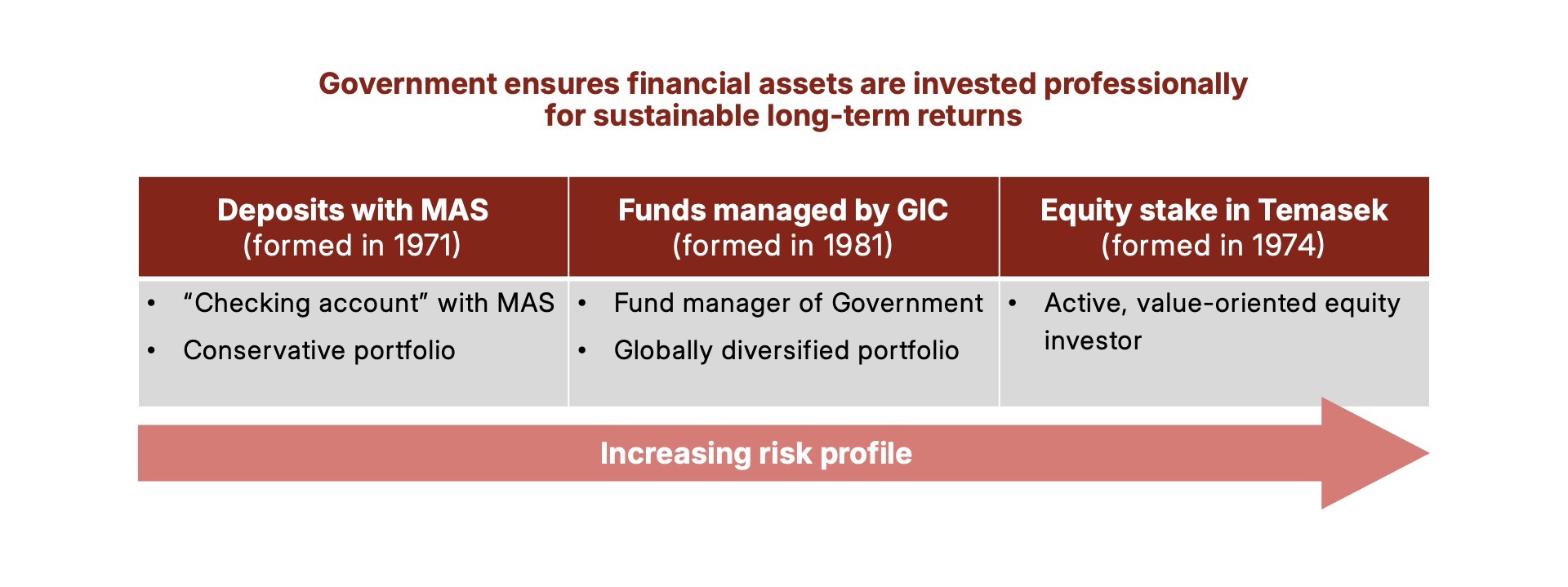

The Government’s assets are mainly managed by GIC Private Limited (GIC). The Government also places deposits with the Monetary Authority of Singapore (MAS); in turn, MAS as a statutory board holds its own assets on its balance sheet. In addition, the Government is the sole equity shareholder of Temasek Holdings (Temasek). Temasek owns the assets on its balance sheet.

The Government does not direct nor influence individual investment decisions made by GIC, MAS and Temasek. At GIC and MAS, whose boards include Ministers, investment decisions are entirely the responsibility of their respective management teams. In the case of Temasek, where the Government has no representation on the Board, investment decisions are fully independent of any Government involvement or influence.

Instead, the Government’s roles are as follows:

First, the Government establishes the overall investment mandates and objectives of GIC, MAS and Temasek.

Second, the Government ensures that each of these entities has a competent board to oversee their management and to ensure that their respective mandates are met.

Third, the Government systematically reviews the overall performance and risks of its whole portfolio of assets invested by the three entities. This includes monitoring whether there is appropriate diversification in terms of asset classes, sectors and geographies. The Government also assesses the impact of various adverse global scenarios across medium to long-term timeframes on the whole portfolio, to ensure that the downside risks to the whole portfolio are not excessive.

Fourth, based on the overall risk profile of the Government’s portfolio, it decides how government capital should be allocated among the three entities. This takes into account the different investment orientations of MAS, GIC and Temasek, each with their own investment risk profile and mandate.

Watch this CNA documentary to see a day in the life of officers from GIC and Temasek, and how they manage the reserves.

![Thumbnail for [Online Special] Inside GIC & Temasek - Pt 3/5 | Singapore Reserves Revealed](https://i.ytimg.com/vi/nTt_YbO9utw/hqdefault.jpg)

Monetary Authority of Singapore

The Monetary Authority of Singapore (MAS), as the central bank of Singapore, manages the Official Foreign Reserves (OFR) of Singapore.

Being a central bank, MAS is the most conservative of the three investment entities, with a significant proportion of its portfolio invested in liquid financial market instruments.

GIC Private Limited

GIC Private Limited is a professional fund manager that manages Government assets. Its mandate is to achieve good long-term returns to preserve and enhance the international purchasing power of the reserves.

GIC is a fairly conservative investor, with a globally diversified portfolio spread across various asset classes. Most of its investments are in the public markets, with a smaller component in alternative investments such as private equity and real estate.

Performance

GIC publishes an annual report on the performance of the Government's portfolio. The information below is extracted from "Report on the Management of the Government's Portfolio" for the Year 2024/25.

GIC's mandate to achieve good long-term returns above global inflation is represented by the primary metric for evaluating GIC's investment performance – the rolling 20-year real rate of return. Over the 20-year period that ended 31 March 2025, the GIC Portfolio generated an annualised real return of 3.8%. The 20-year annualised real rate of return metric is the key focus for GIC, which matches its mandate and investment horizon.

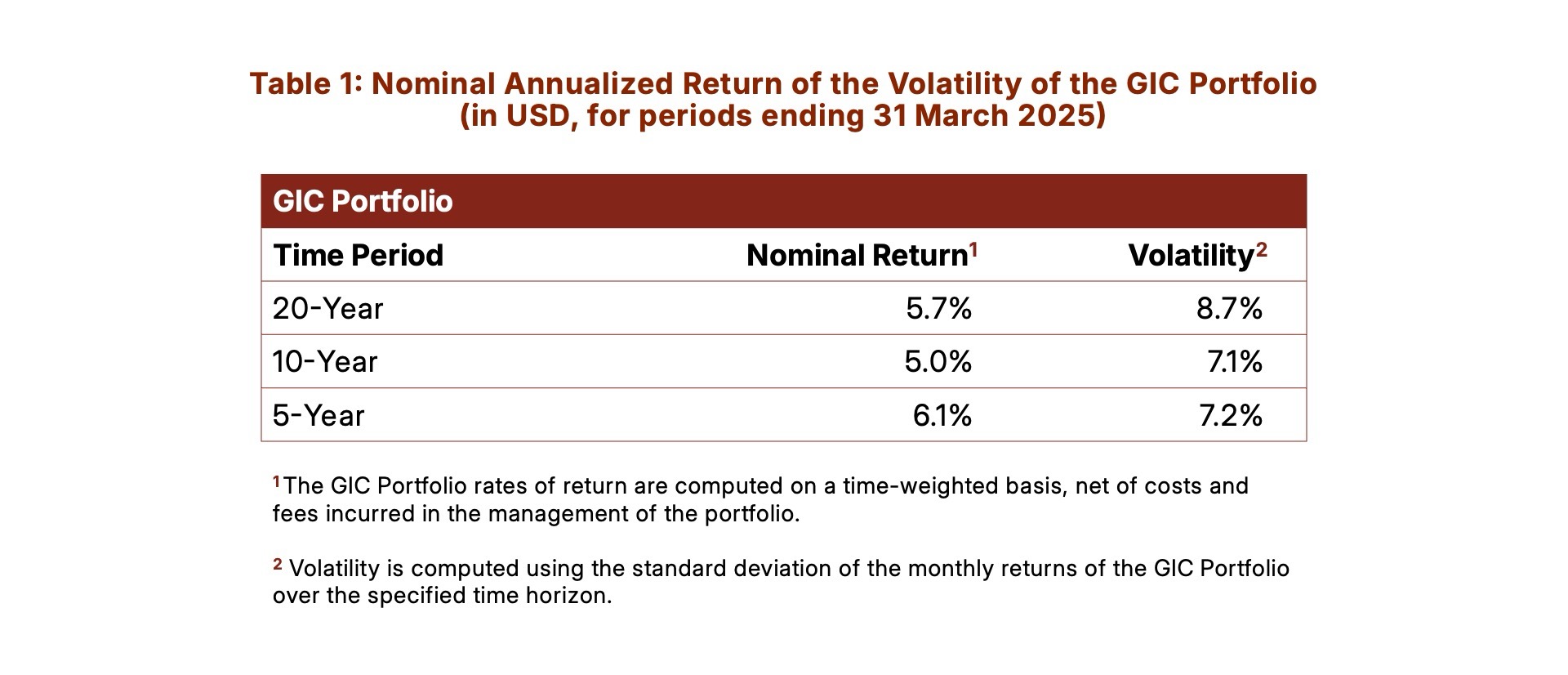

GIC also discloses the nominal rates of return over 5-year, 10-year and 20-year periods. These time frames give a sense of the ongoing performance of the portfolio. The 5-year and 10-year rates of return serve as intermediate markers of GIC's longer term investment performance.

Table 1 shows the portfolio's annualised nominal rates of return over the 5-year, 10-year and 20-year periods in USD terms and the corresponding portfolio volatility.

Over the 20-year, 10-year and 5-year periods ending March 2024, the GIC Portfolio’s returns were in line with the broader asset markets.

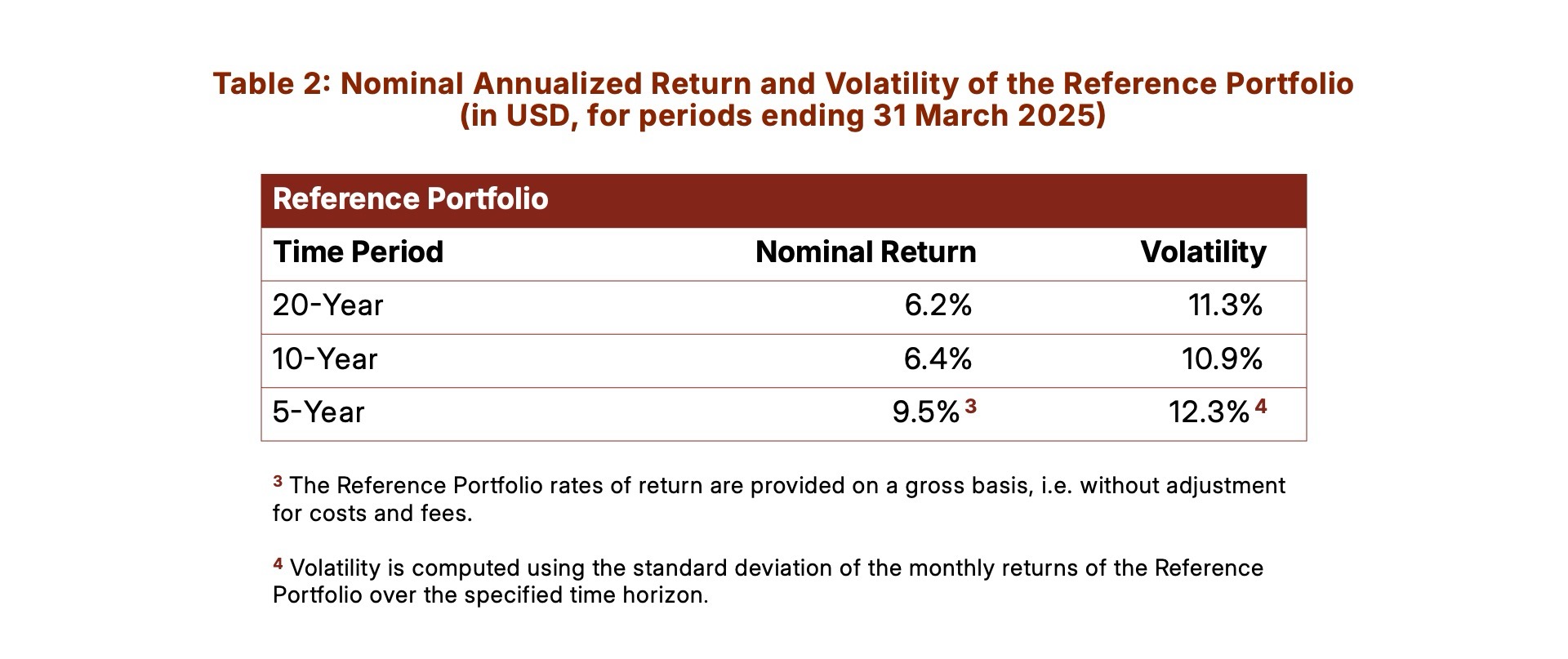

GIC also monitors the performance of a Reference Portfolio which comprises 65% global equities and 35% bonds. The Reference Portfolio is not a performance benchmark for the GIC Portfolio, but serves as a reference for its portfolio risk. It also does not include adjustments for costs that would be incurred when investing.

Table 2 shows the Reference Portfolio's annualised nominal rates of return over the 5-year, 10-year and 20-year periods in USD terms and the corresponding portfolio volatility.

Over the three time periods, and particularly over the last five years, the GIC Portfolio had lower volatility than the Reference Portfolio due to its diversified asset composition and pre-emptive measures to lower portfolio risk. Despite this lower risk exposure than the Reference Portfolio, the GIC Portfolio has performed reasonably and within expectations over a 20-year period. For more information, click here.

Temasek Holdings

Temasek Holdings is a global investment company that operates on commercial principles to deliver sustainable returns over the long term.

Temasek engages its portfolio companies to enhance shareholder value and advocate good governance practices.

A significant portion of Temasek’s portfolio is invested in Singapore. However, since 2002, Temasek has actively expanded its investment footprint across Asia and other markets.

Performance

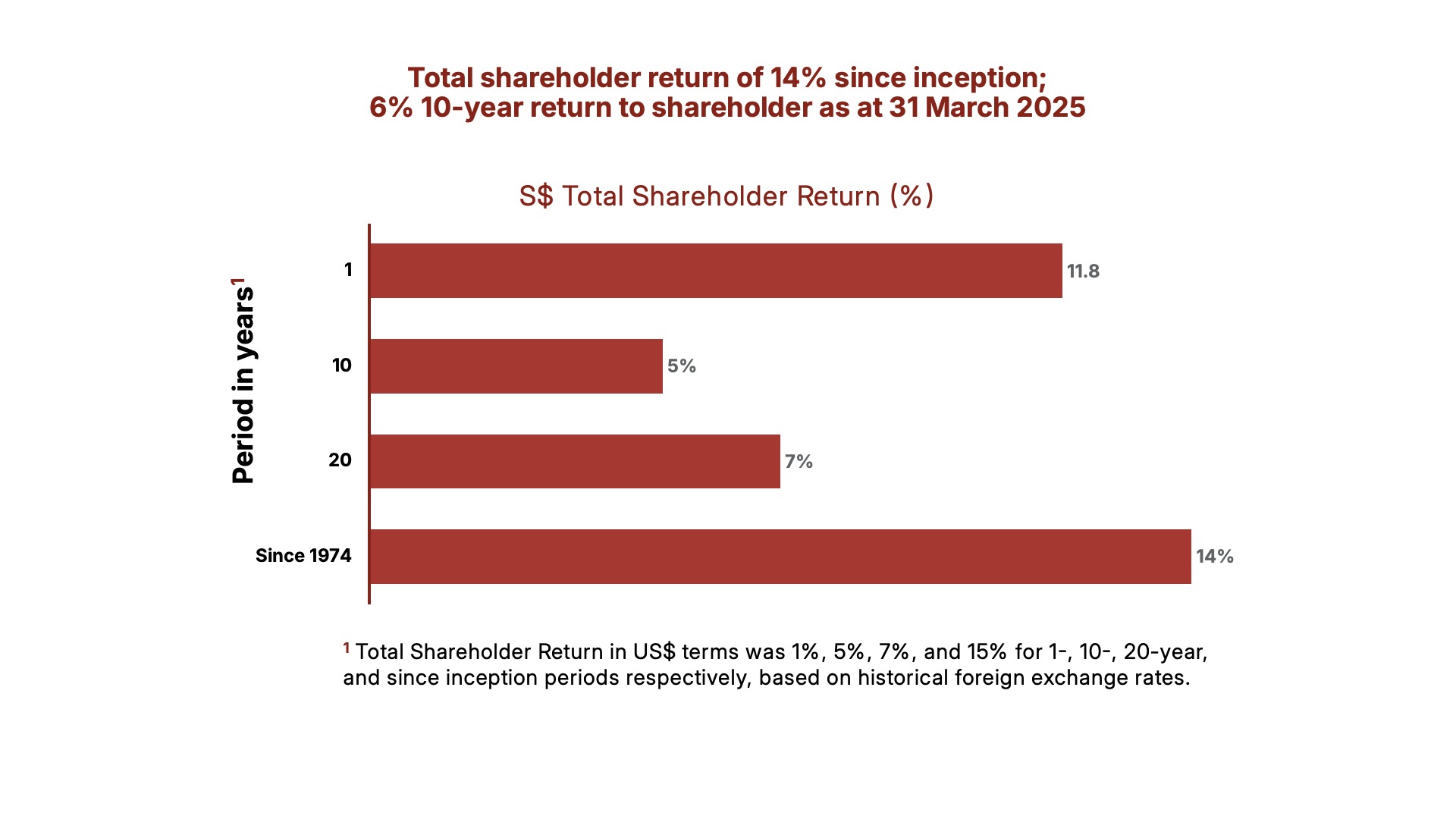

Temasek publishes its annual report, which discloses its annual portfolio value as well as its performance returns – Total Shareholder Returns ‒ over the last 1 year, 10 years, 20 years, and since inception.

Temasek's financial performance is scrutinised by bond rating agencies, which have given it AAA ratings. Temasek's financial statements are audited by an international audit firm.

Temasek's Total Shareholder Returns (since inception, and over the last 10 years and 20 years) as at 31 March 2025 are shown in the chart below.

More information on Temasek's performance can be found in the Temasek Review 2025.

💡 Does Temasek own Changi Airport Group?

Temasek does not own Changi Airport Group (CAG). CAG was corporatised in 2009, and the Government remains the sole shareholder of CAG. Changi Airport is run by CAG's own board and management.

Temasek has no share in CAG and is not involved in Changi Airport's ownership or management. Its performance and financials are therefore not affected by CAG.

How are these entities audited?

MAS' financial statements are audited by the Auditor-General. The main companies in the GIC Group and the Government's portfolio managed by GIC are also audited by the Auditor-General.

To enable him/her to do his work without fear or favour, the position of the Auditor-General is safeguarded under the Constitution – the appointment and removal of the Auditor-General is subject to President’s concurrence.

Temasek's consolidated financial statements are audited by leading international audit firms. In addition, Temasek's financial performance is analysed by bond rating agencies, which have given it a AAA credit rating.

Does the Government assess the performance of the investment entities?

The Government assesses the performance of the investment entities over the long term, rather than individual investments or over the short term where their performances would be influenced by the immediate market cycle.

When any bona fide investment decision is made, there is expectation of a financial gain. However, no large investor is able to avoid taking some losses in investments after they are made, as all investments carry some degree of risk. After an investment is made, any losses arising from its sale at fair market value do not constitute a draw on Past Reserves. Similarly, mark-to-market losses (i.e., falls in the market value of investments that are still being held) are also not considered draws on Past Reserves.

Sustainable Investing

While the Government does not direct the individual investment decisions of its investment entities, nor prescribe climate and sustainability outcomes, the Government expects the investment entities to take into account the impact of climate change on their investments. This should be done in a way that is consistent with their respective mandates, allows them to deliver sustainable returns over the long term, and preserves their reputation with global partners and markets.

GIC, MAS, and Temasek holistically integrate sustainability considerations in their investment processes and have disclosed their sustainability strategies publicly. These can be found in their respective publications (i.e., MAS’ and Temasek’s Sustainability Report, dedicated Sustainability chapters in the GIC Annual Report and Temasek Review).

Does the Government transfer funds to Temasek or GIC to improve their performance?

Transferring of funds by the Government to Temasek or GIC does not improve their performance figures.

As shareholder of Temasek, the Government injects capital into the company through investments in new Temasek shares, taking into account Temasek’s risk and return profile over time. These investments in Temasek’s shares are reflected in Temasek's accounts and are made public.

💡 Do you know?

An occasional misperception is that such capital injections can be used to improve the reported returns performance of Temasek. Capital injections can enable Temasek to increase the size of its portfolio, but do not improve investment returns. Temasek's reported returns figure follows the industry practice of computing returns, which is to deduct any capital injections from (and withdrawals by) the Government in making such calculations. Temasek's returns figure is reviewed and regularly published in its annual report.

In the case of GIC, the allocation of Government funds to GIC for investment management also cannot improve GIC's investment performance figures.

💡 Do you know?

An occasional misperception is that the Government made the Constitutional amendments in 2002 and 2004 to allow for the transfer of Past Reserves between Fifth Schedule entities and the Government to conceal investment losses. This is not true.

The amendments in 2002 and 2004 were made to enable the transfer of Past Reserves within the Reserves Protection Framework (i.e., among the Government and Fifth Schedule entities), without any loss of protection to Past Reserves. Past Reserves cannot be transferred outside of the Reserves Protection Framework without the approval of the President. The amendments in 2002 and 2004 did not alter this position.

Past Reserves may need to be transferred to facilitate the restructuring of Fifth Schedule entities to better deliver public services. For example, the merger of the then-Board of Commissioners of Currency, Singapore (BCCS) with Monetary Authority of Singapore (MAS) in 2002 required the transfer of BCCS' Past Reserves to MAS.

In transferring the Past Reserves from BCCS to MAS, there was no loss in the amount of Past Reserves protected. This was because the Board of Directors of MAS had undertaken to add the Past Reserves transferred from BCCS to the Past Reserves of MAS to be protected.

The Constitutional amendments make clear that there is no draw on Past Reserves as long as: (i) Past Reserves are being transferred among entities that are within the Reserves Protection Framework; and (ii) the receiving entity undertakes to protect the Past Reserves that are transferred over as its own Past Reserves. In such circumstances, the overall amount of Past Reserves being protected is unchanged, and hence the President's approval need not be obtained for such transfers.

Watch SM Lee Hsien Loong’s CNA interview below where he revealed the inner workings of Temasek and GIC.

![Thumbnail for [CNA Exclusive] PM Lee reveals inner workings of Temasek, GIC - Pt 3/3 | Singapore Reserves Revealed](https://i.ytimg.com/vi/l0dY6dk4SBM/hqdefault.jpg)

What is the impact of the NIR framework on the investment entities?

Being included in the NIR framework does not impact the investment strategies of the three entities.

The NIR framework provides a formula to work out how much the Government can spend from the reserves, based on the expected long-term real rates of return of the investment entities in the framework. In doing so, the investment entities are not pressured to sell assets, realise capital gains, and pay more dividends in order to support the Government budget. The NIR framework is designed to ensure that the investment returns are tapped for spending in a disciplined and prudent way.

Unlike dividends, the NIR framework does not require any realisation of cash that needs to be transferred from the investment entities to the Government. The Government maintains Government Deposits with MAS as well as a variety of sources of cash flows to meet its liquidity needs for day-to-day operations. This enables the Government to manage its liquidity needs independent of the cash flows from the three entities’ investment strategies.