Fiscal Policies

To enable macroeconomic stability, support economic growth and promote social equity, through maintaining a balanced budget, investing for the future and ensuring a fair and progressive fiscal system.

On this page

Why do fiscal policies matter?

Fiscal policies are about how a government raises revenue (through taxes and other sources) and how it spends it. As a small country with no natural resources, stewarding our public finances well is critical to our survival and success. Our fiscal policies are designed to support the following key objectives:

Ensuring fiscal sustainability

Supporting growth

Promoting equity

How do we ensure fiscal sustainability?

We aim to run balanced budgets over the long term. This means planning for both current and future needs when designing our fiscal policies.

How do we plan for the long term?

Continued significant demands on fiscal resources to manage longer-term trends and secure a stronger future (Note: Not an exhaustive list of trends or policy priorities)

Fiscal policies in Singapore are characterised by a strong long-term orientation. We prepare early for challenges such as an ageing population, climate change and technological disruptions. Doing so enables us to intervene effectively upstream, avoid more costly interventions downstream and provides time for our society and economy to adjust to the challenges.

Several new spending priorities include:

Ensuring affordable and accessible health and aged care

Investing in early childhood education and continuing education and training

Strengthening retirement adequacy

Renewing our city infrastructure

Managing the green transition

Improving our economic competitiveness

Protecting ourselves against new security threats

Read how the Forward Singapore exercise helps us in our longer-term planning.

What do we spend on?

We focus our public spending on public goods and infrastructure that enable our people and businesses to thrive and grow. We invest heavily in skills, education and infrastructure to develop our people and lay the foundations for long-term economic growth. We also commit a steady amount of spending on security to safeguard our way of life.

💡 Did you know?

Social spending accounts for about half of the Government’s total expenditure. This reflects our commitment to support vulnerable groups and strengthen our social compact.

How do we spend?

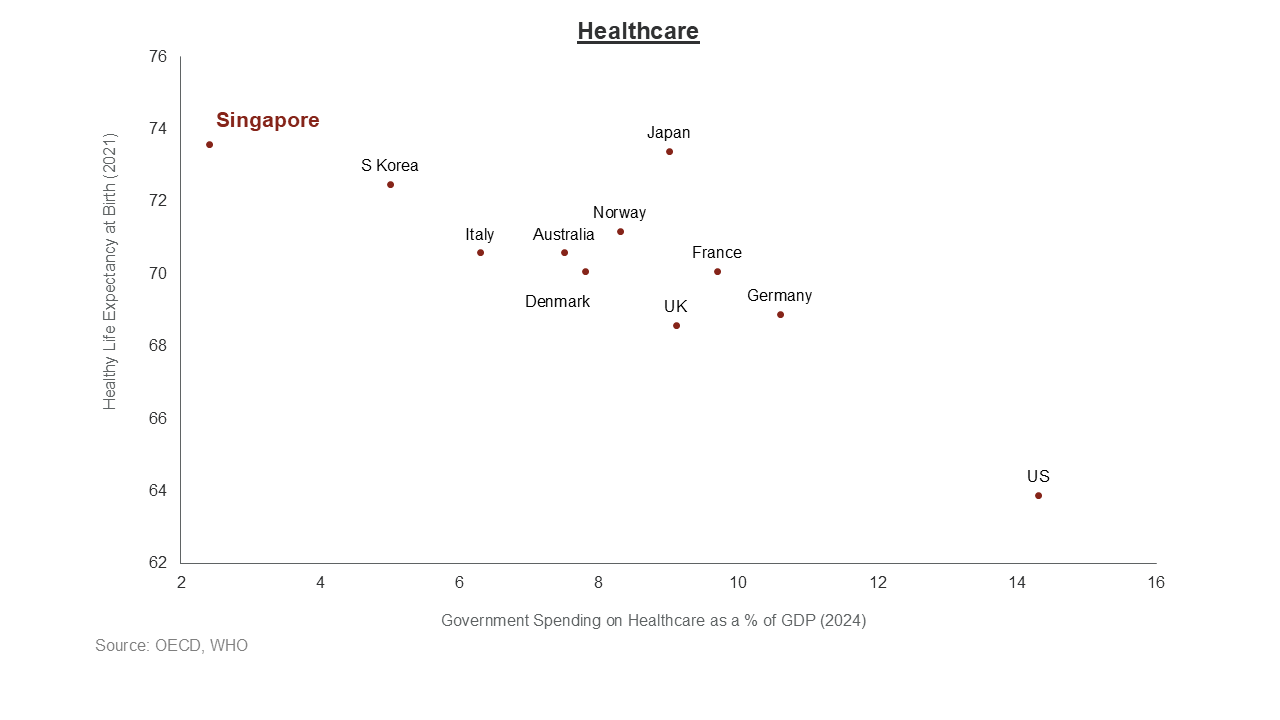

We focus on cost-effective spending, which means to achieve strong outcomes while maintaining a light fiscal burden on taxpayers. Singapore's Government expenditure (as a share of GDP) is among the lowest across advanced economies. Nonetheless, we have consistently achieved good outcomes in areas such as healthcare and education.

How do we use our resources responsibly?

Over the years, Singapore has been prudent and disciplined in building up our reserves.

Our reserves have allowed us to respond quickly and decisively to crises such as the COVID-19 pandemic by supporting Singaporeans and our workers. Unlike many other countries, our reserves have allowed us to do so without borrowing heavily and passing on the financial burden to future generations.

We invest our reserves to generate steady investment returns. Part of the investment returns supplement our annual budget through the Net Investment Returns Contribution (NIRC), contributing about 20% to our Government revenue annually.

We must continue to make our fiscal plans in a responsible and sustainable manner, in a way that ensures that each generation contributes to and benefits fairly from the Budget.

The NIRC makes up about 20% of our government revenue.

Many other advanced economies today spend about 2% of their GDP to service their accumulated debt, and they cover this cost by collecting taxes (as shown at the lower half of the chart below). In Singapore, we have a steady stream of revenue for spending through our NIRC (as shown in the top half of the chart below) to supplement our tax revenues. This helps to keep our taxes low, and, in turn, helps to support many important areas of expenditure that are important to Singapore’s development and future growth.

Singapore’s investment returns (as % of GDP) in comparison to other advanced countries’ debt servicing cost (as % of GDP)

Overall Fiscal Position (OFP)

Access documents and datasets on our Revenue, Expenditure and Overall Fiscal Position.

How do our fiscal policies support growth?

Where do we invest to support future growth?

Singapore continues to devote about 20% of our budget to development and investment. This includes:

Investing strongly to accelerate innovation and digitalisation – in health and biomedical sciences, climate transition and artificial intelligence

Forging global connections – through trade facilitation and digital economy agreements (such as Networked Trade Platform and Global Innovation Alliance)

Investing in our connectivity – through port and airport infrastructure

How do we invest in our people?

We invest strongly in our people across all life stages, starting from the:

Early years through affordable preschool education, KidSTART programme and high-quality public-school system

Strong tertiary pathways through ITE, polytechnics and universities

Lifelong learning through SkillsFuture to keep our workforce relevant

Through these strategies, all Singaporeans have been able to enjoy the fruits of progress. From 2015 to 2025, households across all income groups have experienced real income growth, with relatively stronger gains for the lower and middle deciles.

How do we promote equity and fairness through our fiscal policies?

We seek to achieve a progressive fiscal system that fosters continued social mobility and uplifts the vulnerable in society. It is a constant work in progress.

How does our tax-and-transfer system work?

We are committed to ensure that our overall system of taxes and transfers is progressive. Everyone contributes, with those who are better off contributing more. This allows the Government to redistribute resources to support those with greater needs, while keeping the overall tax burden low for the broad middle.

Over the years, we have strengthened our transfers, with a greater share directed towards the lower-income.

Key programmes include the Workfare Income Supplement, which tops up the income and CPF savings of lower-wage workers, and the Silver Support Scheme, which provides targeted support to seniors who had lower incomes during their working years.

To recognise and honour the contributions of earlier generations to nation building, the Pioneer Generation and Merdeka Generation Packages provided them with significant healthcare subsidies and MediSave top-ups.

How do we strengthen social mobility?

Our fiscal policies aim to provide a foundation of broad-based opportunities that enables everyone to progress over the course of their lives through effort, opportunity and support, regardless of starting points. We strengthen social mobility in the following ways:

To give every child a good start in life, the Government will continue to invest in early childhood education. Children from lower-income families are accorded priority enrolment in preschools. Programmes like KidSTART also provide more support for lower-income parents and caregivers.

As part of broader investments in human capital, the education system has been progressively refined to better develop each student’s strengths and potential. For example, the removal of streaming and the introduction of Full Subject-Based Banding allow secondary school students to learn each subject at a level suited to their abilities, and to adjust these levels as their strengths and interests evolve.

Some families face more complex challenges and require additional support. Under ComLink+, families work with dedicated family coaches to co-develop customised action plans tailored to each family’s unique needs, aspirations, and strengths. Additional financial support is provided through ComLink+ Progress Packages to recognise families’ efforts in taking active steps to improve their circumstances, such as ensuring their children attend preschool and securing stable employment.

At the same time, the Government continues to provide broad-based support to Singaporeans across all life stages, especially in key areas like housing and healthcare, to ensure that essential needs remain accessible and affordable.

These efforts help Singaporeans have a better chance of moving up the income ladder than those in other advanced countries. For the 1985-1989 birth cohorts, 13.8% of those born to families from the lowest 20% by household income made it to the highest 20% by income.

Occasional Paper on Income Growth, Inequality and Social Mobility Trends in Singapore

This paper reviews trends in income growth, inequality and social mobility in Singapore, and outlines the Government’s approach and policies to sustain a fair and inclusive society.