Budget 2020 COVID-19 Measures Brought Significant Relief to Workers, Families, and Businesses

11 Feb 2021Job losses averted, lower-income families got more help

The Ministry of Finance (MOF) published a paper titled “ An Interim Assessment of the Impact of Key COVID-19 Budget Measures”, which takes stock of the relief measures from the five Budgets in 2020 for workers, families and businesses during the COVID-19 pandemic.

2. This paper provides a preliminary analysis on the impact of the Government’s COVID-19 measures across the five Budgets. It summarises how the COVID-19 measures in the five Budgets reached the intended target groups, to help preserve jobs and cushion the pandemic’s impact on businesses and households.

3. The focus of the Budgets, with close to $100 billion committed, evolved in response to changing needs as the COVID-19 situation developed. In the Unity Budget, the Government outlined plans to deal with challenges in a new decade, while the Resilience and Solidarity Budgets focused on helping companies and saving jobs, as well as supporting households. From the Fortitude Budget onwards, the Government continued to provide support to enable businesses and workers to adapt, transform and seize new opportunities to emerge stronger.

4. Commenting on the report, Deputy Prime Minister, Coordinating Minister for Economic Policies and Minister for Finance Mr Heng Swee Keat said, “COVID-19 has been an unprecedented crisis affecting everyone. MOF has just released a preliminary analysis on the impact of the Government’s COVID-19 support across last year’s five Budgets. While many schemes are ongoing, our early findings are that the measures have helped to cushion the impact of the recession. Job losses were averted, and more help went to support families in need. These measures have also made a significant difference to keep our people safe and preserve our livelihoods. The longer-term effects of the Budget measures can only be observed over a longer period of time. We will continue to stay vigilant, as the path to recovery remains uncertain. We will also adapt our support to ensure that those who need it the most will continue to get help, including workers in the hard-hit sectors.”

Measures Cushioned Recession, Averted Job Losses

5. According to estimates by the Monetary Authority of Singapore, the five Budgets in 2020 supported GDP growth by 5.5 percentage points in 2020, helping Singapore avert a deeper economic recession. Coupled with accommodative monetary policy, the economy was estimated to contract by a smaller magnitude of 5.8%[1] instead of 12.4% or more. The total fiscal support, including the Jobs Support Scheme (JSS), is estimated to have helped save or create about 155,000 jobs on average over 2020 and 2021.

Safeguarding Livelihoods

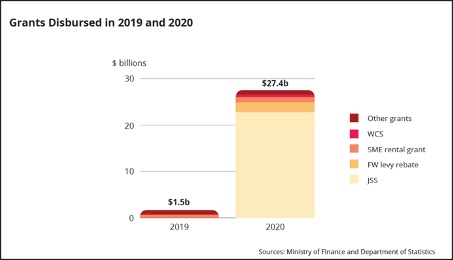

6. About 80% of grants to businesses were for the JSS, which helped to retain local workers. From April to December 2020, a total of $22.6 billion of JSS was disbursed. The $27.4 billion in grants disbursed[2] to businesses in 2020 was significantly more than that in 2019 (see chart below).

7. Financing schemes have also supported firms, with more than 20,000 firms able to obtain access to loans worth more than $17 billion from March 2020 to December 2020. Around 90% of supported businesses were micro and small enterprises.

8. As of December 2020, the SGUnited Jobs & Skills Package (SGUJS) placed nearly 76,000 jobseekers into job and skills opportunities, with most of these in growth sectors such as Information and Communications, Healthcare and Manufacturing. Close to 80% (59,400) were placed into jobs, exceeding the original target of 40,000 jobs while another 9,000 were placed on traineeships and attachments. This comprised close to 5,400 fresh graduates emplaced on SG United Traineeships, and more than 3,600 mid-career individuals placed in company-hosted training and attachments under the SGUnited Mid-Career Pathways Programme (SGUP).

9. Preliminary estimates of the Jobs Growth Incentive (JGI) take-up were encouraging. In September and October, the first two months of the scheme, 110,000 local jobseekers were hired under the JGI across 26,000 eligible employers.

10. In all, the SGUJS supported workers and fresh graduates to enter new jobs or take up meaningful skills opportunities that will boost their employability and be better positioned for the economic recovery.

Social Support for All, Inequality Mitigated

11. Singaporean households received about $2,000 per member on average from COVID-19 measures. These measures refer to the Care and Support Package (CSP), Self-Employed Person Income Relief Scheme (SIRS), COVID-19 Support Grant (CSG) and Temporary Relief Fund (TRF). Lower income households and those living in smaller HDB flat types received higher levels of support.

12. The broad-based CSP, which benefited all households, accounted for 70% of the benefits received. Lower-income households received higher levels of support from components that were intended to benefit them, such as the Workfare Special Payment and Grocery Vouchers.

13. After accounting for government transfers and taxes, the Gini coefficient in 2020 fell from 0.452 to 0.375. The redistributive impact in 2020 can be attributed to the design of the COVID-19 social support schemes, which were tilted to provide more help to those with lower incomes and who may lack other forms of support. While COVID-19 has sharpened inequalities around the world, the Budget 2020 measures have helped to mitigate inequality in Singapore.

###

Issued by Ministry of Finance

Singapore

11 Feb 2021

- The full paper can be found here

- Infographics

[1]

Based on Advance Estimates by the Ministry of Trade and Industry (MTI).

[2] This was followed by the foreign worker levy rebate, Wage Credit Scheme and rental grants for small and medium-sized enterprises.