950,000 HDB Households to receive GST Voucher – U-Save rebates and S&CC rebates in April 2022

31 Mar 2022They will receive double their regular U-Save this FY; Total U-Save and S&CC rebates for the year will amount to about $720 million

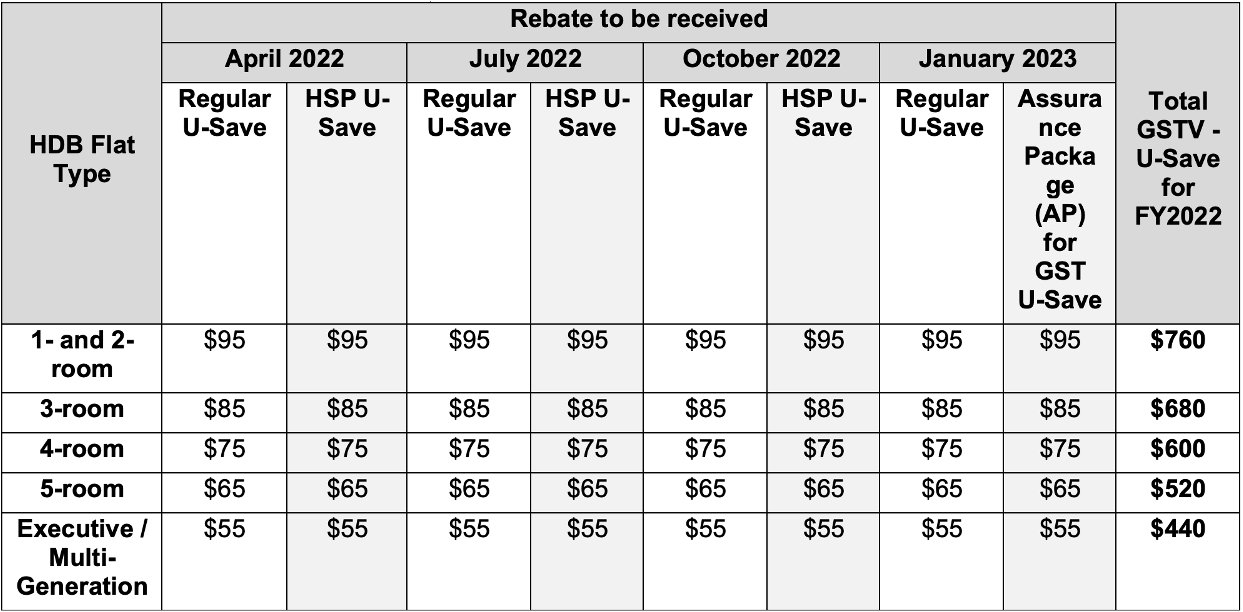

Table 1: GSTV – U-Save for FY2022

Notes:

- Households whose members own more than one property are not eligible for GSTV – U-Save.

- Additional rebates will be credited to eligible households at the same time as their regular GSTV – U-Save in the usual four quarters (April 2022, July 2022, October 2022, and January 2023).

- The AP U-Save will be provided quarterly starting from January 2023 and ending in January 2026.

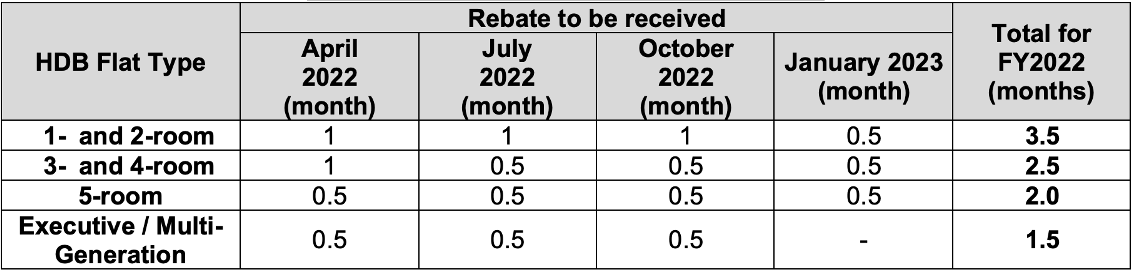

5 The GSTV – S&CC rebates that households will receive in this FY are summarised in the table below.

Table 2: GSTV – S&CC rebates for FY2022

Notes:

Notes:

- Eligible households will receive their GSTV – S&CC rebates in April 2022, July 2022, October 2022, and January 2023.

- Households with no Singapore citizen flat owner or occupier in the flat, whose flat owner(s) or essential occupier(s) own or have any interest in a private property, or have rented out the entire flat, are not eligible for the S&CC Rebate.

6 The GSTV – S&CC rebates will be credited directly into households’ S&CC accounts managed by their respective Town Councils. Households do not need to take any action to benefit from the rebates.

More Information

7 Residents can check or enquire on their eligibility for GSTV – S&CC Rebate by logging into My HDBPage at www.hdb.gov.sg with their Singpass and following these steps: My Flat > Purchased Flat/Rental Flat > S&CC Rebate. Residents with specific queries on their household’s S&CC payment or account status can contact their respective Town Councils.

8 For queries on the GSTV – U-Save, you may contact SP Group (6671-7117 / customersupport@spgroup.com.sg). More information on the GSTV scheme, including Frequently Asked Questions are at https://www.gstvoucher.gov.sg/Pages/faqs.aspx.

9 For further details, please refer to Annex A on the enhanced permanent GSTV scheme, Annex B on the 2022 HSP, and Annex C on the AP. Illustrations of how Singaporean households benefit in FY2022 are in Annex D.

Issued by:

Ministry of Finance

Singapore

31 March 2022