Review on Social Benefits for Lower and Middle Income Households

02 Nov 2020

Parliamentary Question by Mr Gan Thiam Poh:

To ask the Prime Minister (a) what are the direct and indirect social benefits given to lower-income and middle-income households considering that lower-income and middle-income households receive proportionately more benefits than the taxes they pay; and (b) whether the Government will conduct a review on the current social benefits to ensure no one in lower-income and middle-income households has been left out and be more inclusive in support of the disadvantaged and less fortunate groups.

Parliamentary Reply by Deputy Prime Minister, and Minister for Finance, Mr Heng Swee Keat:

The Government is committed to building a caring and inclusive society, bridging gaps and reducing inequalities for a fair and just society. Over the years we have steadily increased our social expenditure. We now spend three times as much on social programmes each year than we did 15 years ago.

2. The underlying philosophy of our system is that everyone contributes according to their means, and wealth is redistributed by the state. All Singaporeans benefit, but those with less receive more and those with the least receive the most. With your permission, Mr Speaker, may I ask the Clerk to distribute the handouts?

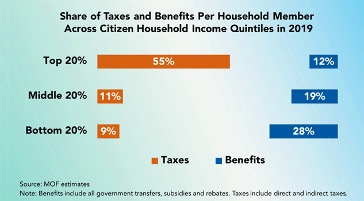

a. Lower- and middle-income households receive significantly more transfers and subsidies than the taxes they pay, whereas higher-income groups contribute far more in taxes than the transfers and subsidies they receive.

b. For instance, the bottom 20% of households account for less than 10% of all taxes paid, but receive almost 30% of all benefits disbursed[1]. In contrast, the top 20% of households account for 55% of taxes, and receive a smaller amount – about 10% – of the benefits.

Handout 1: Share of Taxes and Benefits

3. I will now elaborate on how our lower- and middle-income households are supported in the areas of education, work, housing, retirement, healthcare, and social assistance.

4. First, education.

a. We believe that the best form of support for all Singaporeans is developing the individual at every stage of life and giving them access to opportunities through good education and continued employment. Education from pre-school to Institutes of Higher Learning (IHLs) is heavily subsidised.

b. By the time a Singaporean child reaches 16, he or she would have benefitted from more than $180,000 in education subsidies, including pre-school subsidies. Those who go on to an IHL, which most students do, benefit from another $15,000 to $22,000 in subsidies per year.[2]

c. Students from lower-income families will receive more as:

i. Families can pay as little as $3 per month for full-day childcare, and have their primary and secondary school fees fully subsidised. Additional support is also available through the Opportunity Fund and for transport.

ii. We have also recently enhanced tertiary bursaries for students from the 2020 Academic Year so that students from lower-income households pay fees as low as $150 per year for their polytechnic education, and can receive further support for their living expenses.

5. Second, work.

a. We provide significant support to help workers stay employed as we believe that a job is the best form of welfare.

b. We uplift the wages and productivity of lower-income workers through the Workfare Income Supplement scheme and Progressive Wage Model. We also made a Workfare Special Payment of $3,000 in 2020.

c. We also provide help for lower-income workers to upgrade their skills and boost their career mobility through the Workfare Skills Support scheme.

6. Third, housing

a. We provide significant subsidies to Singaporean households for housing, with the bulk of the subsidies going to the lower- and middle-income. Heavily subsidised rental housing is available for the lower-income who are unable to afford to purchase a flat of their own.

b. Those purchasing an HDB flat for the first time can receive up to $160,000 in housing subsidies, including the Enhanced CPF Housing Grant.

c. In 2019, about 85% of the bottom 20% of households owned a home, which is much higher than even the overall homeownership rates in many other countries.

7. Fourth, retirement:

a. We support Singaporeans in meeting their retirement needs. The CPF system helps Singaporeans build their retirement wealth by providing risk-free interest rates of up to 6%. The Government provides regular top-ups to the MediSave accounts of lower-income Singaporeans and seniors through the GST Voucher scheme. Further, Silver Support helps seniors who had lower incomes throughout life and who now have little or no family support.

8. Fifth, healthcare:

a. For healthcare, Singaporeans receive subsidies of up to 80% for hospitalisations, with the lower-income receiving more. Lower- and middle-income households also receive higher subsidies for outpatient treatment, and for MediShield Life and CareShield Life premiums.

b. Together with MediShield Life and MediSave, 7 in 10 subsidised hospitalisation bills incurred no cash payment in 2018.

9. Lastly, social assistance:

a. Social and community assistance is available to those with higher needs. ComCare provides Short-to-Medium-Term Assistance for lower-income Singaporeans who are temporarily unable to work or looking for employment and require financial assistance, as well as Long-Term Assistance for those unable to work due to old age, illness, or disability.

b. Lower- and middle-income Singaporeans also receive support under the GST Voucher scheme, to offset some of their GST expenses.

c. We also provide grants to the Social Service Agencies to run key programmes for the vulnerable, such as befriending services for Persons with Disabilities (PWDs) and seniors, at subsidised rates.

10. In this difficult time, the Government has taken unprecedented measures to provide Singaporeans relief from the economic impact of COVID-19.

a. All Singaporeans benefited from the Care and Support Package in 2020, with more benefits going to the lower income.

b. One in four households also received support for unemployment or income loss through the Temporary Relief Fund, COVID-19 Support Grant, or Self-Employed Person Income Relief Scheme. Nearly 80% of recipients came from households at the 60th household income percentile and below.

c. Singaporeans living in 2-room or smaller HDB flats, including rental flats, have also received $300 in Grocery Vouchers in 2020, and will receive an additional $100 in 2021.

d. The Community Development Council (CDC) Vouchers Scheme launched on 12 June 2020 has helped up to 400,000 lower-income Singaporean households – identified through various Government help schemes – with vouchers that can be used to redeem food, essential items, and services at local hawker stalls and heartland merchant shops near their homes.

11. We regularly review our policies to better support the needs of Singaporeans. In particular, we study if our schemes are reaching the intended groups, and also if adjustments are needed to the amount of assistance.

a. For example, the Silver Support Scheme, which was introduced in 2016, will be enhanced from 2021 to benefit about 100,000 more seniors. The payouts will also be increased by 20%, to up to $900 per quarter, as announced in the Unity Budget in February 2020.

b. For lower wage workers, the tripartite partners have agreed to form a Tripartite Workgroup on Lower Wage Workers, to study how to expand the Progressive Wage Model and provide wage growth and job progression opportunities to these workers. We look forward to their recommendations.

12. We will continue to review our social policies, taking into account the changes in our socio-economic landscape and our economic circumstances.

***

[1]Taxes include direct and indirect taxes. Benefits disbursed include all Government transfers, subsidies, and rebates (e.g. implicit education subsidies, housing grants).

[2]Full-time Nitec / Higher Nitec courses: $14,900

Publicly-funded full-time diploma courses: $16,700

Publicly-funded full-time degree courses: $21,600