Annual Breakdown Amounts of Additional Buyer's Stamp Duty Collected from Singaporeans Buying Second, Third and Subsequent Residential Properties Respectively over Last Five Years

14 Feb 2022Parliamentary Question by Mr Chua Kheng Wee Louis:

To ask the Minister for Finance over the last five years, what are annual breakdown amounts of Additional Buyer’s Stamp Duty (ABSD) that have been collected from (i) Singapore citizens buying a second property and (ii) Singapore citizens buying a third and subsequent residential properties, respectively.

Parliamentary Reply by Minister for Finance, Mr Lawrence Wong:

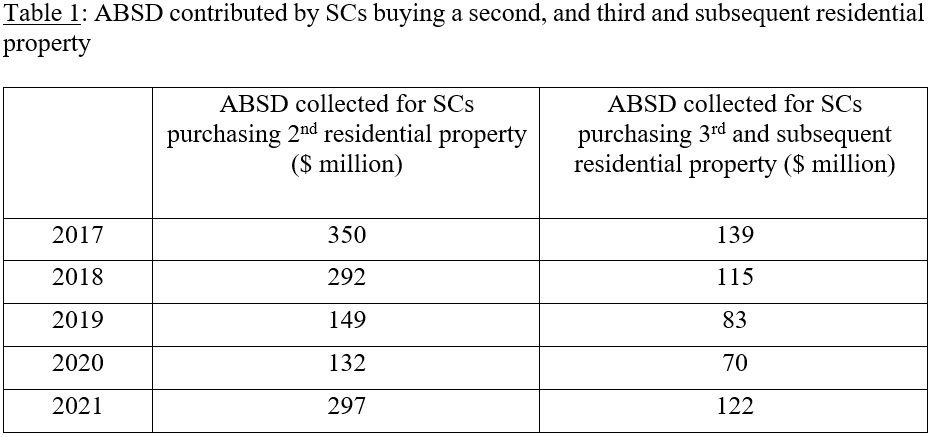

From 2017 to 2021, the average annual amount of Additional Buyer’s Stamp Duty (ABSD) collected from SCs buying a second residential property was around $244 million. The average annual amount of ABSD collected from SCs buying a third and subsequent residential property was around $106 million. The annual breakdowns are provided in Table 1 below.

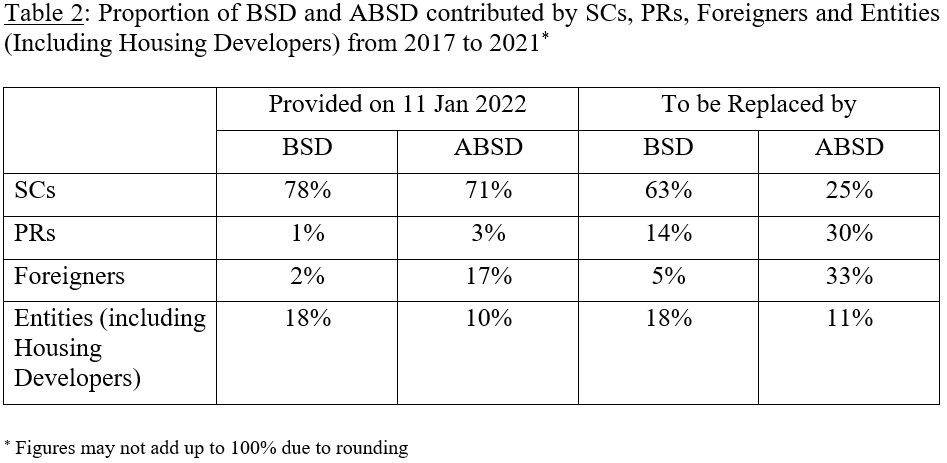

In working out the above information, IRAS had identified errors in an earlier set of data, which was provided in response to Mr Chua’s written Parliamentary Question on the breakdown of Buyer’s Stamp Duty (BSD) and ABSD collected from SCs, Permanent Residents (PR), foreigners, and entities (including housing developers), and published on 11 January 2022. [Please refer to "Data on Residential Property Stamp Duties and Additional Buyer's Stamp Duties Collected in Last 10 Years", 11 January 2022, Official Report, Vol 95, Issue No 45, Written Answers to Questions section.]

The figures should instead be as in Table 2 below. IRAS apologises for the mistake.

For purchases where the parties are of mixed citizenship statuses (e.g. SC and PR joint purchasers), the transfer is categorised under the profile with the highest ABSD rate (i.e. SC-PR joint purchasers are categorised under PR).