Summary

The reserves refer to the total assets minus liabilities of the Government and other entities specified in the Fifth Schedule under the Constitution1.

Government’s assets include:

Physical assets like land and buildings;

Financial assets like cash, securities and bonds.

Government’s liabilities include:

Singapore Government Securities (SGS), which are issued for purposes of developing our domestic debt market and providing a risk-free benchmark against which other risky market instruments are priced off.

Special Singapore Government Securities (SSGS), which are Government bonds issued to the CPF Board. CPF monies are invested in these special securities which are fully guaranteed by the Government. The securities earn for the CPF Board a coupon rate that is pegged to CPF interest rates that members receive.

Q1. What does the Constitution protect?

The Constitution protects Past Reserves.

Past Reserves refers to the reserves accumulated during previous terms of Government. To prevent reckless spending by a Government that could result in a drawdown of Past Reserves, the Constitution protects the Past Reserves of the Government and Fifth Schedule entities. The reserves of each entity are separately protected for clear accountability.

Q2. Who manages our reserves?

Given their strategic importance, it is vital that we enhance the long-term value of our reserves. To achieve this, the assets are invested professionally and on a strictly commercial basis, with the aim of generating sustainable returns over the long term. The

Government's assets are mainly managed by GIC Private Limited. The Government also places deposits with the MAS; in turn, MAS as a statutory board holds its own assets on its balance sheet. In addition, the Government is the sole equity shareholder of Temasek Holdings (Temasek). Temasek owns the assets on its balance sheet.

Information on the Government's deposits with MAS is available here.

Monetary Authority of Singapore

The MAS, as the central bank of Singapore, manages the Official Foreign Reserves (OFR) of Singapore. Information on the OFR is available here.

Being a central bank, MAS is the most conservative of the three investment entities, with a significant proportion of its portfolio invested in liquid financial market instruments.

GIC is a professional fund management organisation that manages Government assets. Its objective is to achieve good long-term returns to preserve and enhance the international purchasing power of the reserves.

GIC is a fairly conservative investor, with a globally diversified portfolio spread across various asset classes. Most of its investments are in the public markets, with a smaller component in alternative investments such as private equity and real

estate.

Temasek is an investment company managed on commercial principles to create and deliver sustainable long-term value for its stakeholders.

Temasek is an active, value-oriented equity investor that aims to maximise shareholder value over the long term.

Q3. How does MAS accumulate Official Foreign Reserves?

We provide an explanation of the flow of funds that leads to the accumulation of Official Foreign Reserves (OFR), as well as the periodic transfer of excess OFR from MAS to Government.

On 11 January 2022, Parliament passed the MAS (Amendment) Bill which enables MAS to subscribe for Reserves Management Government Securities (RMGS) issued by the Government. In exchange, MAS will transfer to the Government OFR that are in excess of what MAS needs to conduct monetary policy and ensure financial stability (henceforth referred to as “excess OFR” for short).

The amendment to the MAS Act does not change in any way how MAS accumulates OFR. Neither does it change the principles on which excess OFR is transferred from MAS to the Government, nor create new domestic money supply in the process. This section

explains these matters and clarifies certain misconceptions.

What are the sources of OFR accumulation?

OFR is accumulated when MAS purchases US dollars in

exchange for Singapore dollars, in order to moderate the appreciation of the Singapore dollar exchange rate. It is hence a consequence of MAS' monetary policy, which since the early 1980s has been focused on keeping the exchange

rate within its target policy band.

The appreciation pressure on the Singapore dollar has reflected both supply and demand factors within the flow of funds. Chief among these have been the following two factors:

• Public sector operations which withdraw supply of Singapore dollars from the system. These occur when the government records overall surpluses, and because of government borrowings through issuance of Singapore Government Securities (SGS) in the bond market, and issuance of Special Singapore Government Securities (SSGS) to the CPF Board.

- The proceeds of SGS and SSGS issuance cannot be spent in the Government budget, and hence contribute to overall public sector surplus monies that are placed with MAS in the form of government deposits.

- Together, these public sector

operations result in a withdrawal of Singapore dollar liquidity from the domestic banking system, which leads to appreciation pressures on the Singapore dollar.

• Capital inflows into Singapore which increase the demand for Singapore dollars. These capital inflows reflect Singapore's strong economic and financial fundamentals, as reflected in its triple-A credit rating over many years.

These too lead to appreciation pressures on the Singapore dollar.

MAS' monetary policy operations ensure that the appreciation pressures on the Singapore dollar, whichever their source, do not compromise the objective of its exchange rate-centred monetary policy or domestic money market conditions. When MAS hence intervenes in the foreign exchange market by purchasing US dollars for Singapore dollars, it accumulates OFR.

Over the 1980s to the 2000s, both the supply and demand factors highlighted above contributed significantly to appreciation pressures on the Singapore dollar, and OFR accumulation. Until about 25 years ago, the Government ran large surpluses which together with SGS and SSGS issuance, led to a significant contraction of Singapore dollar liquidity.

However, in the last decade, it is large capital inflows that have chiefly contributed to the increase in OFR accumulation.

- With rising expenditures for healthcare, other social spending and infrastructure, the Government's surpluses and thus its deposits with MAS have declined significantly.

- However, there has been a significant increase in capital inflows into Singapore, reflecting exuberant liquidity conditions in global financial markets and confidence in Singapore. As a result, the Singapore dollar exchange rate has faced strong appreciation pressures, necessitating MAS to step up its intervention operations to prevent an undue strengthening in the domestic currency.

- This has led to an accumulation of OFR despite declining government surpluses.

How are reserves transferred from MAS to Government?

Since 1981 when GIC was set up, MAS has been making periodic transfers to the Government of OFR that has been in excess of

what it needed to conduct monetary policy and ensure financial stability.

This has enabled the Government to invest

foreign reserves through GIC on a longer-term basis while still ensuring that MAS has sufficient OFR to carry out its mandate.

Previously, these transfers of OFR were accompanied by a drawdown of Government deposits with MAS.

- As reflected on MAS' balance sheet, this involves a reduction in both its assets and liabilities, with no change in MAS' net assets: in exchange for the OFR that MAS transfers to Government (i.e. a reduction of MAS assets), the Government draws

down its deposits with MAS (i.e. a reduction in MAS liabilities).

This transfer mechanism worked as long as the Government ran sizeable surpluses, contributing to significant deposits with MAS. With the decline in government surpluses and deposits with MAS, a new mechanism is needed to enable the transfer of excess

OFR from MAS to the Government.

Hence the issuance of RMGS by the Government to MAS in exchange for OFR.

- As reflected on MAS' balance sheet, this leads to a replacement of one form of assets for another. MAS' transfer of foreign currency assets (OFR) will be replaced by a domestic asset that is a claim on the Government (RMGS).

Whether the transfer of

OFR from MAS to the Government is achieved through a drawdown of Government deposits with MAS or the issuance of RMGS to MAS, there is no change in MAS' net assets.

Does RMGS lead to new domestic money creation or central

bank financing of the Government budget?

There is no new money creation arising from the purchase of RMGS by MAS.

“Monetary financing” of governments typically happens when central banks purchase government securities on the primary market and credit the proceeds to the government, i.e. the central bank “prints money” to help fund

the government budget.

The purchase by MAS of RMGS is fundamentally different. It does not involve MAS creating Singapore dollars to give to the Government to spend. Instead, MAS is transferring excess OFR – its foreign currency

assets – to the Government. In fact, the legislation allows MAS to transfer only foreign currency assets to the Government in exchange for RMGS. This eliminates the possibility of MAS creating Singapore dollars to finance government

spending.

MAS' subscription to RMGS is also not a form of “quantitative easing”.

In some of the advanced economies, quantitative easing (“QE”) consists of the purchase of securities – including government securities – in the secondary market by the central bank, leading to an expansion of commercial

banks' deposit balances with the central bank. This represents an increase in the monetary base which supports the creation of new money. But MAS' subscription to RMGS is not a transaction with commercial banks. It does not expand the banks'

balances with MAS. In fact, the size of MAS' balance sheet does not change when it subscribes to RMGS. There is only a shift in the composition of its assets as explained above. (Please refer also to FAQs on RMGS here.)

In short, the introduction of RMGS does not change the flow of funds leading to OFR being accumulated by MAS. Neither does it alter the rationale or principles upon which excess OFR is transferred from MAS to the Government. It only changes the mechanism by which this transfer of excess OFR is effected.

Q4. What is the Government's role with regard to the investment decisions made by GIC, MAS and Temasek?

The Government plays no role in decisions on individual investments that are made by GIC, MAS and Temasek. At GIC and MAS, whose boards include Ministers, investment decisions are entirely the responsibility of their respective management teams. In the case of Temasek, where the Government has no representation on the Board, investment decisions are fully independent of any Government involvement or influence.

The Government's role is instead as follows:

First, the Government establishes the overall investment mandates and objectives of GIC, MAS and Temasek.

Second, the Government ensures that each of these entities has a competent board to oversee their management and seek to ensure that their respective mandates are met.

Third, the Government systematically reviews the overall risks of its whole portfolio of assets invested by the three entities. This includes monitoring whether there is appropriate diversification in terms of asset classes, sectors and geographies. The Government also assesses the impact of various adverse global scenarios across medium to long-term timeframes on the whole portfolio, to ensure that the downside risks to the whole portfolio are not excessive.

Fourth, based on the overall risk profile of the Government's portfolio, it decides how government capital should be allocated among the three entities. This takes into account the different investment orientations of MAS, GIC and Temasek, which place them at different parts of the spectrum of investment risk.

Q5. Who audits the financial statements of our investment entities?

MAS' financial statements are audited by the Auditor-General. The main companies in the GIC group and the Government's portfolio managed by GIC are also audited by the Auditor-General.

To enable him/her to do his work without fear or favour, the Auditor-General is appointed by the President and his/her position is safeguarded under the Constitution and the Audit Act.

Temasek's consolidated financial statements are audited by leading international audit firms. In addition, Temasek's financial performance is analysed by bond rating agencies, which have given it a AAA credit rating.

Q6. Why does the Government not disclose the overall size of our reserves?

MAS and Temasek publish the size of the funds they manage. As of 31 March 2023, the Official Foreign Reserves managed by MAS was S$416 billion and the size of Temasek's net portfolio value was S$382 billion.

It is the size of the Government's funds managed by GIC that is not published. What has been revealed is that GIC manages well over US$100 billion. Revealing the exact size of assets that GIC manages will, taken together with the published assets of MAS and Temasek, amount to publishing the full size of Singapore's financial reserves.

It is not in our national interest to publish the full size of our reserves. Our reserves are a strategic asset, and especially so for a small country with no natural resources or other assets. We need to prepare for extreme tail-risk scenarios. This could include a crisis of unprecedented scale that causes an outflow of capital in excess of what MAS holds. It could also be emergency scenarios precipitated by state or non-state actors that threaten our economy and livelihoods, or even our existence as a nation. Our reserves are a key defence for Singapore in times of crisis. Just as our defence forces do not reveal the full extent of our weaponry and military capabilities, it will be unwise to reveal the full and exact resources at our disposal.

Q7. We have already accumulated a significant amount of reserves. Why can’t we spend more from our reserves (e.g. increase NIRC contribution)? This will still allow our reserves to grow, but only at a slightly slower pace.

We do not know how much reserves is enough since we cannot tell the scale and complexity of the problems we face in the future.

• For example, the Government drew down $4 billion from past reserves in 2009 during the Global Financial Crisis.

• To protect lives and livelihoods, the Government had to draw down $40 billion between FY20-FY22 during the COVID-19

pandemic.

• We cannot tell how much more we will need as worse crises may come our way. The interval between crises may also shorten.

The Government is not over-saving. While our reserves are growing, the size of our economy, the challenges facing our economy and the complexity of our needs are growing even faster. In fact, the growth of the reserves is already expected to slow.

• Our investment returns are subject to significant headwinds in the global investment environment – increasing geopolitical tensions, climate change, ageing populations, low productivity growth.

• Furthermore, investments do not have guaranteed outcomes, and we cannot choose at will when to slow down or increase the pace of returns.

What we have now is a fair balance between the needs of today and tomorrow. Spending more of our reserves now, such as by increasing the amount of NIRC we spend, would cause us to save less for the future. It is important that we continue to have a rainy-day fund which can help Singaporeans tide through future crises.

Spending more from the reserves now would also mean future generations would likely end up paying more taxes to fund their needs.

The Statement of Assets and Liabilities (SAL) is part of the Government Financial Statements (GFS) that are submitted to Parliament at the end of each financial year in accordance with the Constitution.

The Government's total

financial assets as reflected in the SAL do not represent the size of our national reserves.

a. The SAL reflects how the cash and investment balances of the Government are accounted for in funds and deposit accounts that are

established in accordance with the laws governing them.

b. The Government's total financial assets records the gross assets comprising cash and investments that are set aside in these funds and deposit accounts.

c.

These assets include Government borrowings such as the Special Singapore Government Securities issued to the CPF Board. The Government's total financial assets is thus not a proxy for the size of the reserves.

More details can

be found in the explanatory notes to the SAL within the GFS.

Q9. What constitutes a draw on Past Reserves?

A draw on Past Reserves can occur in several ways.

First, a draw on Past Reserves occurs if the Government or a Fifth Schedule entity spends more than the reserves it has accumulated during the current term of Government.

Second, a draw on Past Reserves takes place when an asset is sold below its fair market value and the difference is not topped up from the reserves that were accumulated in the current term of Government. Fair market value is the price that a willing buyer and willing seller, at arms' length, would transact at.

Q10. Why are Past Reserves used to fund land-related projects?

Past Reserves are used to fund land-related projects such as land reclamation and the creation of underground space2 like the Jurong Rock Cavern as well as land acquisition projects like Selective En-bloc Redevelopment Scheme (SERS)3. This is a conversion of Past Reserves from one form (financial assets) to another (State land). The land and space that is created or acquired forms part of our State land holdings and is hence protected as Past Reserves. Further, when such land or space is subsequently sold, the proceeds accrue fully to Past Reserves. There is thus no drawdown of Past Reserves.

Q11. Is an investment loss considered a draw on Past Reserves?

No, an investment loss does not constitute a draw on Past Reserves, as long as the disposal of the investment is done at fair market value.

The reserves protection framework aims to prevent any form of sale that is deliberately carried out at below fair market value, e.g. by avoiding the need to seek explicit approval for a draw on Past Reserves.

When any bona fide investment decision is made, there is expectation of a gain. However, no large investor is able to avoid taking some losses in investments after they are made, as investments carry some element of risk.

After an investment is made, any losses arising from its sale at fair market value do not constitute a draw on Past Reserves. Similarly, mark to market losses (i.e. falls in the market value of investments that are still being held) are also not considered a draw on Past Reserves.

The issue of whether there are investment gains or losses is therefore distinct from the question of whether there is a draw on Past Reserves.

Whether the entities which manage the reserves are making a gain or loss has to be evaluated based on changes in their overall portfolio values rather than by how much they have made or lost on individual investments. Further, we have to look at how they have performed over the long term, rather than over the short term where their performances would be influenced by the immediate market cycle. (See also Q11)

Q12. How have GIC and Temasek performed? What information is available on their investment returns?

GIC

GIC's mandate is to achieve good long-term returns, to preserve and enhance the international purchasing power of Government reserves.

GIC publishes an annual report on the performance of the Government's portfolio. The information below is extracted from its latest annual report (“Report on the Management of the Government's Portfolio" for the Year 2022/23).

GIC's mandate to achieve good long-term returns above global inflation is represented by the primary metric for evaluating GIC's investment performance – the rolling 20-year real rate of return. Over the 20-year period that ended 31 March 2023, the GIC Portfolio generated an annualised real return of 4.6%. The 20-year annualised real rate of return metric is the key focus for GIC, which matches its mandate and investment horizon.

GIC also discloses the nominal rates of return over 5-year, 10-year and 20-year periods. These time frames give a sense of the ongoing performance of the portfolio. The 5-year and 10-year rates of return serve as intermediate markers of GIC's longer term investment performance.

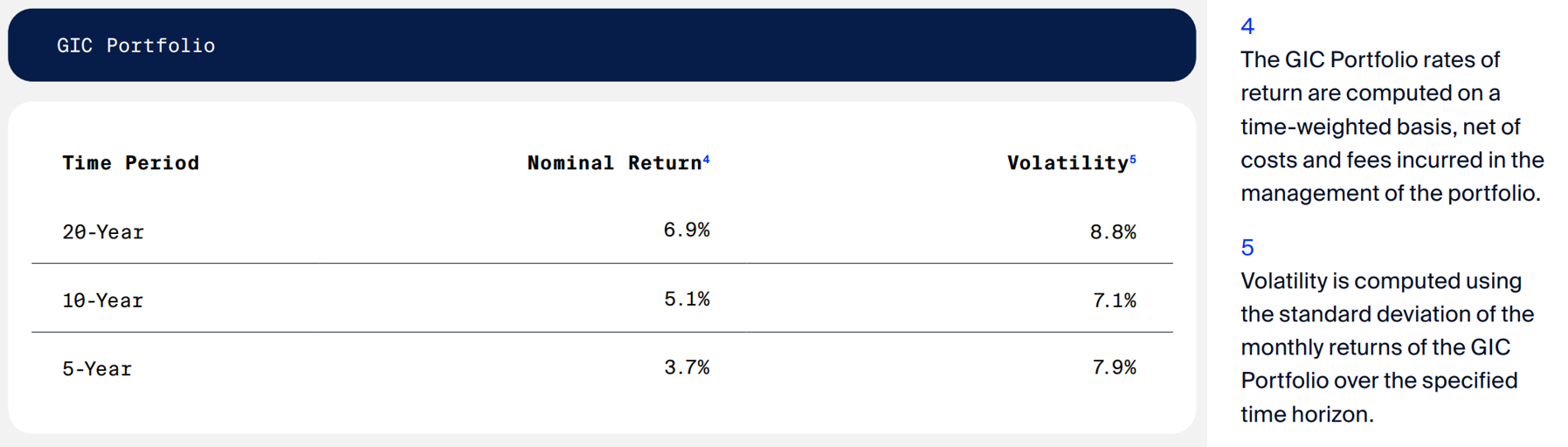

Table 1 below shows the portfolio's annualised nominal rates of return over the 5-year, 10-year and 20-year periods in USD terms and the corresponding portfolio volatility.

Table 1: Nominal Annualized Return and Volatility of the GIC Portfolio (in USD, for periods ending 31 March 2023)

Over the 20-year, 10-year and 5-year periods ending March 2023, the GIC Portfolio returned 6.9%, 5.1%, and 3.7% per annum in nominal USD terms, in line with the broader asset markets.

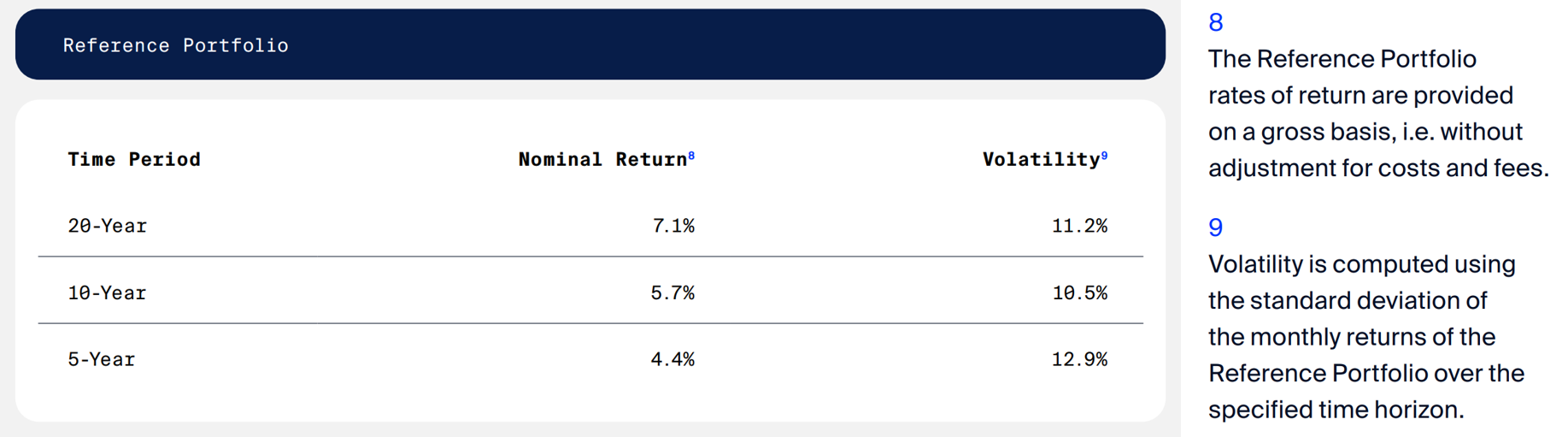

GIC also monitors the performance of a Reference Portfolio which comprises 65% global equities and 35% bonds. The Reference Portfolio is not a performance benchmark for the GIC Portfolio, but serves as a reference for its portfolio risk. It also does not include adjustments for costs that would be incurred when investing.

Table 2 below shows the Reference Portfolio's annualised nominal rates of return over the 5-year, 10-year and 20-year periods in USD terms and the corresponding portfolio volatility.

Table 2: Nominal Annualized Return and Volatility of the Reference Portfolio (in USD, for periods ending 31 March 2023)

Over the three time periods, and particularly over the last five years, the GIC Portfolio had lower volatility than the Reference Portfolio due to its diversified asset composition and pre-emptive measures to lower portfolio risk. Despite this lower risk exposure than the Reference Portfolio, the GIC Portfolio has performed creditably over a 20-year period.

For more information, click here.

Temasek

Temasek's aim is to maximise shareholder value over the long term. A significant portion of Temasek's portfolio is invested in Singapore. However, since 2002, Temasek has taken active steps to invest in Asia and other markets.

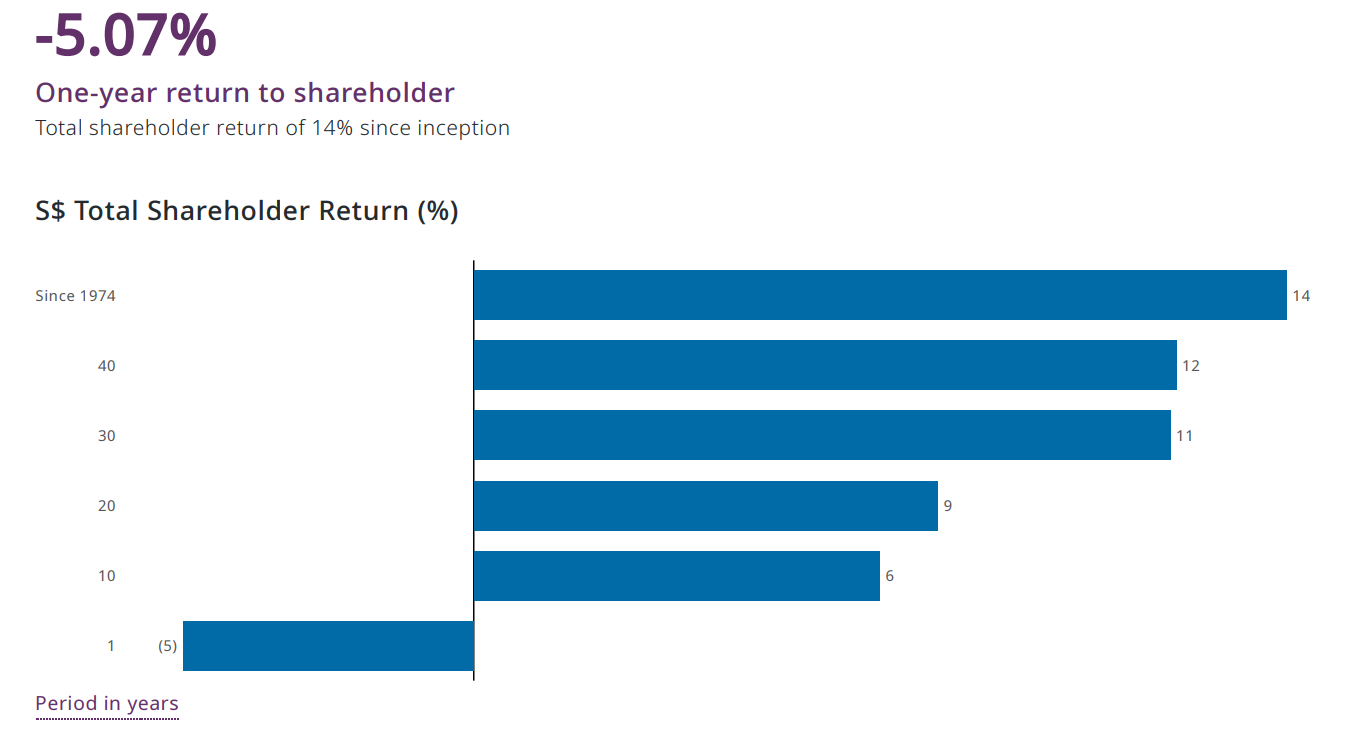

Temasek publishes an annual report that discloses its annual portfolio value as well as its performance returns – Total Shareholder Returns (by Market Value) ‒ over the last 1 year, 10 years, 20 years, 30 years, 40 years and since inception.

Temasek's financial performance is scrutinised by bond rating agencies, which have given it AAA rating. Temasek's financial statements are audited by an international audit firm.

Temasek's Total Shareholder Returns (by Market Value) as at 31 March 2023 are shown in the chart below.

More information on Temasek's performance can be found in the Temasek Review 2023 (See online version here)

Q13. Have GIC and Temasek lost value as a result of the financial crisis in 2008-2009?

GIC and Temasek have fully recovered from the global financial crisis. During the financial crisis, the portfolios managed by GIC and Temasek had suffered declines in their portfolio values in line with global market declines. However, these declines came after much greater increases in their portfolio values in the preceding five years. For example, Temasek's portfolio increased by S$124 billion over the preceding five years ‒ from the time the market cycle commenced in April 2003 to March 2008.

Taking the cycle as a whole ‒ from the start of the crisis and through the recovery ‒ both GIC and Temasek have done creditably in comparison to their international peers among major global managers. They have fully recovered their declines in portfolio values occurred during the crisis. More importantly, both GIC and Temasek have earned creditable returns over longer periods (see Q12).

The long-term investment orientation of GIC and Temasek has allowed them to tolerate short-term volatility and ride out market cycles, in order to achieve long term gains. To evaluate their performance, we therefore have to look at how they performed over the long term, rather than in the short term where their performances would be influenced by the immediate market cycle. Moreover, they have to be evaluated based on overall long-term returns rather than by how much they have made or lost on individual investments.

Q14. How does the Government hold the investment entities accountable for their performance? What governance processes are in place?

The Government ensures that each entity has a competent board to oversee management and to ensure that their respective mandates are met. Boards are expected to instil good corporate governance practices.

In turn, the Government holds the respective boards accountable for good long-term performance. The Government regularly engages the board and management of each entity on its portfolio risk and performance, and assesses whether these are appropriate in the context of its investment mandate and approach.

As part of the President's role to safeguard Past Reserves, the President has oversight of the entities' annual budgets, needs to concur with key appointments, and has access to information available to their boards including their audited financial statements.

Q15. What are the investment entities' approaches to investing sustainably? Does the Government set sustainability targets for entities?

The Government does not set specific sustainability targets or approaches for the investment entities, just as the Government does not direct their investment decisions. This preserves the entities' commercial independence.

However, the Government expects the entities to integrate sustainability considerations into their respective investment processes. This should be done in a way that best suits their respective mandates, allows them to deliver sustainable returns over the long term, and preserves their reputation with global partners and markets. The entities are aware of the Government's sustainability goals and plans for the nation.

MAS, GIC and Temasek have disclosed their sustainability approaches publicly. These can be found in their respective publications (i.e., MAS's Sustainability Report, dedicated Sustainability chapters in the GIC Annual Report and Temasek Review)

Q16. Has the Government transferred funds to Temasek or GIC to show better performance?

No, the Government has not and does not transfer funds to Temasek or GIC to improve their performance figures.

As shareholder in Temasek, the Government injects capital into the company taking into account its risk and return profile over time. These capital injections are reflected in Temasek's accounts and are made public.

An occasional misperception is that capital injections can be used to improve the reported returns performance of Temasek. Capital injections can enable Temasek to increase the size of its portfolio, but do not improve investment returns 5. Temasek's reported returns figure follows the industry practice of computing returns, which is to deduct any capital injections from (and withdrawals by) the Government in making such calculations. Temasek's returns figure is reviewed and regularly published in its annual report.

In the case of GIC, the allocation of Government funds to GIC for investment management also cannot improve GIC's investment performance figures.

Q17. What factors have contributed to Temasek's performance over time? Has Temasek's performance benefited from the “transfer of Government's assets” such as Singtel?

As at 31 March 2023, Temasek's Total Shareholder Return since inception (1974) was 14% p.a. in SGD terms. This TSR since inception would have benefited from the transfer of Government companies such as SingTel to Temasek, their transformation, and the subsequent listing of these assets.

Temasek published information on this issue in 2014:6

(a) Performance of Temasek's newer vintage investments (made after 31 March 2002)

Since 2002, it became an active investor in Asia and other markets as part of its strategy to reshape its portfolio for the longer term.

Its investments in external markets have provided a boost to Temasek's long-term returns. This portfolio of newer vintage Temasek investments has delivered an annualised return of 15% to Temasek in SGD terms from 1 April 2002 to 31 March 2014.

(b) Performance of its older vintage investments (held as at March 2002)

The older vintage portfolio of Temasek companies benefited from, as well as contributed to, Singapore's transformation and growth in the earlier years. Companies like SingTel and PSA have contributed to a competitive and efficient infrastructure for the Singapore economy. Through Temasek's stewardship and management of these assets, the Government has been able to unlock and grow their value.

The transfer of Government companies such as SingTel to Temasek ‒ and the subsequent listing of these assets ‒ had contributed to Temasek's total shareholder returns by market value.

For the period after 1 April 2002, the performance of this portfolio of earlier Temasek assets did not have any “boost” from IPO listings. These earlier assets have continued to perform well relative to the markets, showing annualised returns of 11% in SGD terms from 1 April 2002 to 31 March 2014. Over the same period, the MSCI Singapore Index showed annualised returns of 7% in SGD terms (inclusive of reinvestment of dividends).

Temasek has performed creditably over the long term. Temasek's consolidated financial statements are audited by leading international audit firms. In addition, Temasek's financial performance is analysed by bond rating agencies, which have given it a AAA credit rating. (See also Q12)

Q18. Who owns Changi Airport Group (CAG)? Does Temasek have a stake in CAG?

CAG was corporatised in 2009, and the Government remains the sole shareholder of CAG. Changi Airport is run by CAG's own board and management.

Temasek has no share in CAG. It is not involved in Changi Airport's ownership or management. Its performance and financials are therefore not affected by CAG.

Q19. Can reserves be transferred easily among our investment entities to buffer their losses?

No. An occasional misperception is that the Government made the Constitutional amendments in 2002 and 2004 to allow for the transfer of Past Reserves between Fifth Schedule entities and the Government so as to be able to conceal investment losses. This is wrong.

We have explained that a transfer of funds cannot be used to hide investment losses (see Q16).

The amendments in 2002 and 2004 were made to enable the transfer of Past Reserves within the Reserves protection framework (i.e. among the Government and Fifth Schedule entities), without any loss of protection to Past Reserves. Past Reserves cannot be transferred outside of the Reserves protection framework without the approval of the President. The amendments in 2002 and 2004 did not alter this position.

Past Reserves may need to be transferred to facilitate the restructuring of Fifth Schedule entities to better deliver public services. For example, the merger of the then-Board of Commissioners of Currency, Singapore (BCCS) with Monetary Authority of Singapore (MAS) in 2002 required the transfer of BCCS' Past Reserves to MAS.

In transferring the Past Reserves from BCCS to MAS, there was no loss in the amount of Past Reserves protected. This was because the Board of Directors of MAS had resolved that the Past Reserves transferred from BCCS would be added to the Past Reserves of MAS and protected.

The Constitutional amendments make clear that there is no draw on Past Reserves as long as (i) Past Reserves are being transferred among entities that are within the Reserves protection framework; and (ii) the receiving entity undertakes to protect the Past Reserves that are transferred over. In such circumstances, the overall amount of Past Reserves being protected is unchanged, and hence the President's approval need not be obtained for such transfers.

Footnotes:

Fifth Schedule entities refer to key statutory boards and Government companies that are listed in the Fifth Schedule under the Constitution. Examples of Fifth Schedule entities are CPF Board, MAS, HDB, GIC and Temasek. The reserves of these entities are protected under the Reserves protection framework.

Past Reserves are used to fund only expenditure directly related to the creation of land, but not for the construction of infrastructure on the land.

Past Reserves are used to fund only the land component of the total compensation of the acquisition costs.

The NIRC comprises up to 50% of the Net Investment Returns on the net assets invested by GIC, MAS and Temasek, and up to 50% of the investment income from the remaining assets.

Investment gains/losses are always tracked by comparing the current market value of investments held against the historical purchase price for these investments. Capital injections do not increase or decrease the current market value or historical purchase prices of investments.

See page 18-22 of the 2014 Temasek Review here.

If you do not already have Adobe Reader or Microsoft Word, please download the software for free here: [Adobe Reader] [Microsoft Word]