950,000 HDB Households to benefit from GST Voucher – U-Save rebates and GSTV – S&CC rebates (second quarterly tranche) in July 2022

01 Jul 2022Total of $720 million in U-Save and S&CC rebates for households in FY2022

About 950,000 Singaporean households living in HDB flats will receive their second quarterly GSTV – U-Save and GSTV – S&CC rebates in July 2022. These rebates are part of the enhanced permanent GST Voucher (GSTV) scheme and Household Support Package (HSP) announced at Budget 2022, and will provide continuing help to defray the GST and other living expenses of lower- to middle-income Singaporean households.

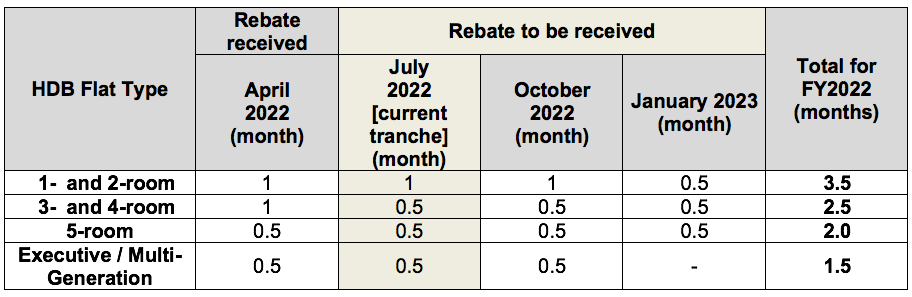

2. Under the enhanced GSTV scheme, eligible households will receive GSTV – S&CC rebates to offset between 1.5 and 3.5 months of their S&CC each year. The rebates are disbursed in April, July, October, and January.

3. In FY2022, eligible households will receive double their regular U-Save. This amounts to about 8 to 10 months’ worth of utility bills for the average household living in 1- and 2-room HDB flats, and about 4 to 6 months’ worth of utility bills for the average household living in 3- and 4-room HDB flats.

4. The GSTV – U-Save and S&CC rebates are in addition to the $100 Household Utilities Credit for all Singaporean households, separately announced on 21 June 2022 under the $1.5 billion Support Package.

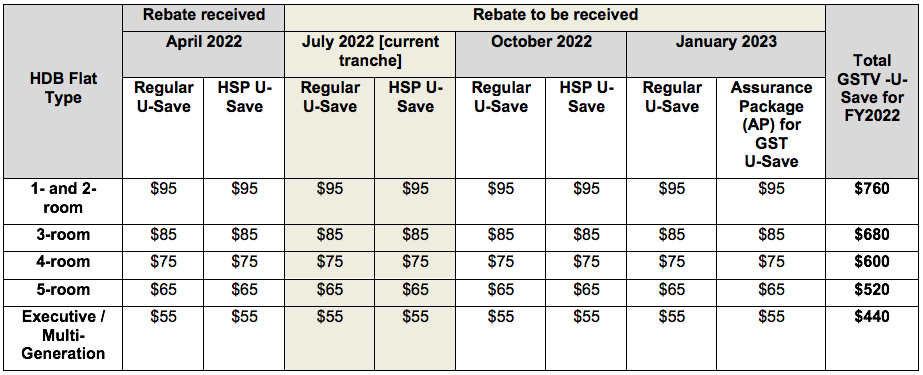

5. The GSTV – U-Save rebates that households will receive in FY2022 are summarised in the table below.

Table 1: GSTV – U-Save for FY2022

Notes:

- Households whose members own more than one property are not eligible for GSTV – U-Save.

- Additional rebates will be credited to eligible households at the same time as their regular GSTV – U-Save in the usual four quarters (April 2022, July 2022, October 2022, and January 2023).

- The AP U-Save will be provided quarterly starting from January 2023 and ending in January 2026.

6. The GSTV – S&CC rebates that households will receive in this FY are summarised in the table below.

Table 2: GSTV – S&CC rebates for FY2022

Notes:

- Eligible households will receive their GSTV – S&CC rebates in April 2022, July 2022, October 2022, and January 2023.

- Households with no Singapore citizen flat owner or occupier in the flat, whose flat owner(s) or essential occupier(s) own or have any interest in a private property, or have rented out the entire flat, are not eligible for the S&CC Rebate.

7. The GSTV – S&CC rebates will be credited directly into households’ S&CC accounts managed by their respective Town Councils. Households do not need to take any action to benefit from the rebates.

More Information

8. Residents can check or enquire on their eligibility for GSTV – S&CC Rebate by logging into My HDBPage via HDB InfoWEB with their Singpass and following these steps: My Flat > Purchased Flat/Rental Flat > S&CC Rebate. Residents with specific queries on their household’s S&CC payment or account status can contact their respective Town Councils.

9. For queries on the GSTV – U-Save, you may contact SP Group (6671-7117 / customersupport@spgroup.com.sg). More information on the GSTV scheme, including Frequently Asked Questions are at https://www.gstvoucher.gov.sg/Pages/faqs.aspx.

10. For further details, please refer to Annex A for illustrations of support for Singaporeans.

Issued by:

Ministry of Finance

Singapore

1 July 2022