A. Introduction

- 1. Mr Speaker, I thank all Members who have spoken and supported the Budget.

- 2. Members have raised many suggestions during this debate. I will not be able to address all of them in my response. But I assure you that we have heard your feedback, and we will study your suggestions carefully. For more detailed issues relating to specific schemes and programmes, these will be addressed later at the Committee of Supply.

- 3. The questions raised by Members in this debate largely revolve around three issues.

- a. Are we doing enough to help Singaporeans cope with higher prices?

- b. How will we achieve better growth and help Singaporeans secure a better future?

- c. Is our system of social support sufficient to support Singaporeans?

- 4. Let me address these three issues in turn.

B. Are we doing enough to help Singaporeans cope with inflation?

- 5. First, on helping Singaporeans cope with inflation and cost pressures. Several Members, including Mr Yip Hon Weng, Mr Gan Thiam Poh, Mr Henry Kwek, Ms Hazel Poa and many others, spoke about this.

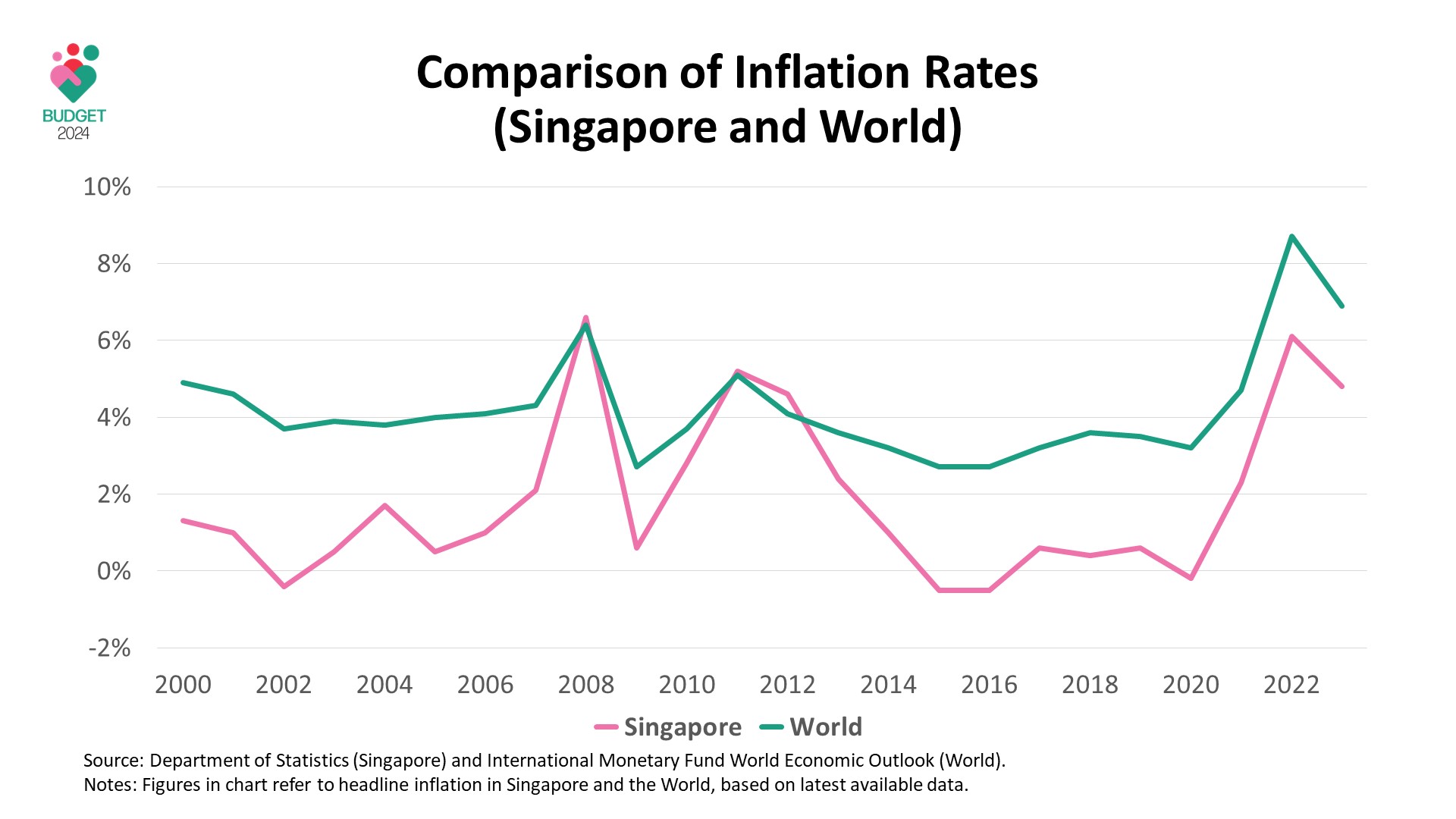

- 6. Let us start by looking at the reasons for high inflation over the last two years. These reasons are certainly not unique to Singapore. For more than a decade before Covid, global inflation was generally stable, hovering at around 4% per annum. Singapore enjoyed relatively stable inflation too, and in most years, it was lower than global inflation.

- 7. But in 2021, prices in global food, goods, and energy markets rose quickly, as strong demand came up against constrained supply due to pandemic-related restrictions.

- 8. Then the Russia-Ukraine war broke out in early 2022. The two countries are major suppliers of key commodities, like oil and gas, fertiliser, and wheat. This brought about a further surge in prices. Many countries also saw a surge in demand for domestic services, and did not have sufficient workers to meet the demand.

- 9. These are the key drivers of inflation everywhere. Singapore, like all other countries, felt the impact too.

- 10. Even so, inflation in Singapore did not reach the peaks seen in several parts of the world.

- 11. One reason was effective monetary policy. MAS tightened monetary policy five consecutive times starting in October 2021. This meant allowing the Singapore dollar to appreciate more quickly, which helped to shield us against the sharp spike in imported inflation. Had MAS not acted, core inflation for the whole of 2023 would have been 6.6%, instead of 4.2%.

- 12. Other major central banks acted too.

- 13. With the overall monetary tightening and the stabilisation of supply chains, significant headway has been made in bringing inflation down around the world.

- 14. Overall inflation has come down, in line with the rest of the world. In Singapore, our headline inflation was already moderating since last year, and is expected to moderate further this year. We expect this trend to continue, similar to other advanced economies.

- 15. Several Members, including Ms Ng Ling Ling, Mr Ong Hua Han, and Mr Faisal Manap, also highlighted other specific cost items – namely in housing and transport. So, let’s drill deeper into this data.

- 16. Take public housing. Over the last 10 years, the average price of a 4-room BTO flat in non-mature estates has remained relatively stable, even as median household incomes increased. So, in real terms, the affordability of such BTO flats has, in fact, improved. The challenge we faced was with the prices of BTO flats in choicer locations, which are more expensive. That is why we introduced the new Standard, Plus, and Prime framework. With this framework, we can keep the BTO flats in these better locations affordable through more upfront subsidies. But it will be a fair system, because the additional subsidies will be clawed back when the first owners sell the flats.

- 17. Or take public transport. The Government is already providing generous subsidies to keep our public transport system going. Fares have increased, but household incomes have risen faster. That is why the proportion of household income spent on public transport has fallen over the last 10 years.

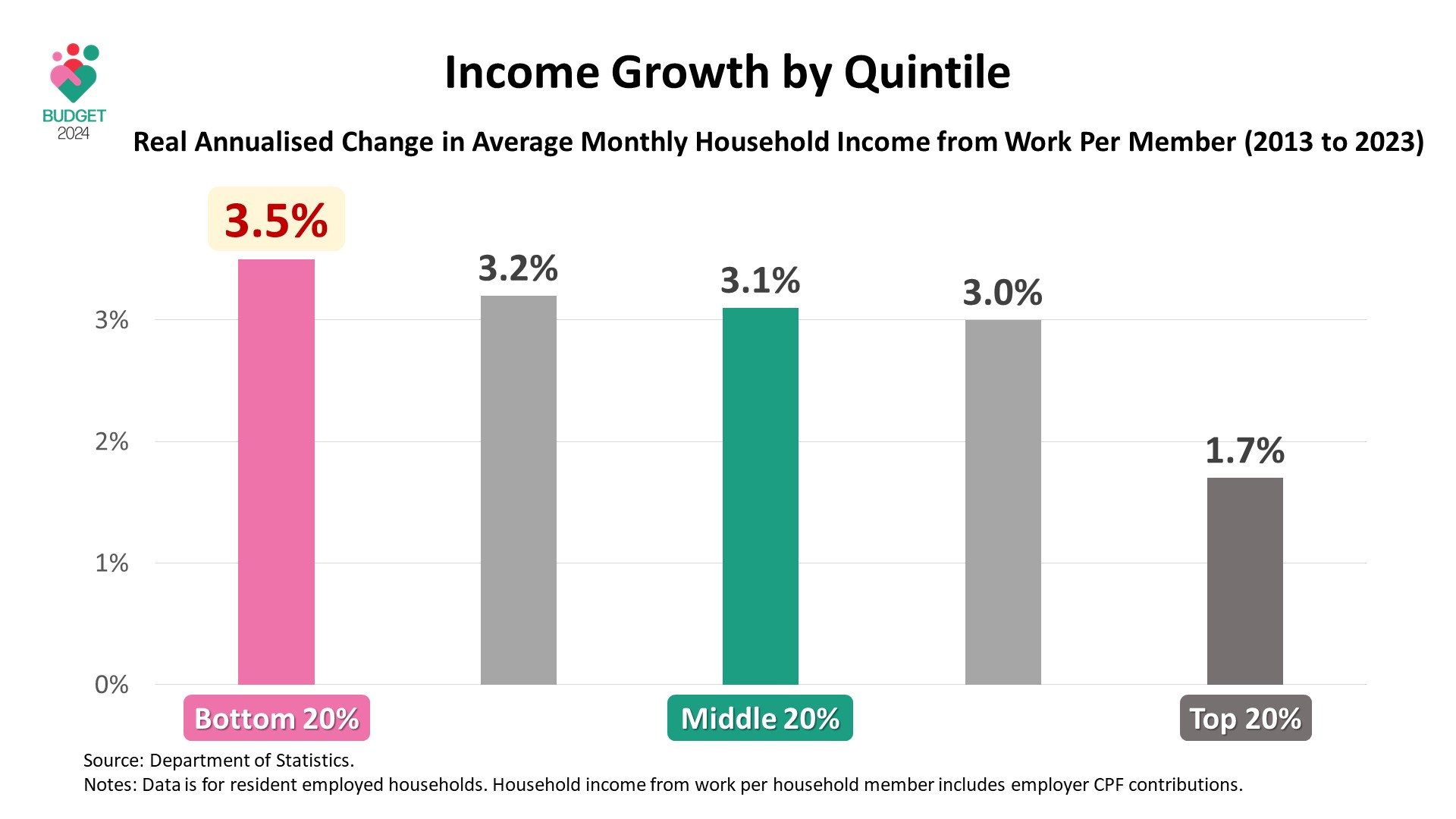

- 18. We also track real wages closely. As Members are aware, real wage growth was negative last year. But we know that many employers are complaining of shortage of workers and higher wage costs, especially in services. So, it is not negative across the board. Some workers are still getting real wage increases, and at the household level, there was real median income growth, on a per household member basis.

- 19. Sir, I have provided some key data points, so that we can understand the facts around the inflation situation globally and in Singapore.

- 20. In countries everywhere, including in Singapore, there tends to be a gap between economic data and perceptions. It is partly because it takes time for consumers to adjust to new economic realities.

- 21. Perceptions and sentiments are clearly important, and we take the feedback from the ground seriously, but we also need to examine the data closely to better shape policy responses.

- 22. It is in this broader context that the Government had extended support packages over the last two years to cushion the impact of inflation, particularly for lower- and middle-income Singaporeans.

- 23. This year, while inflation is moderating, we recognise that prices are still relatively high, and there are continued pressures for families and individuals. That is why I have enhanced the Assurance Package in this Budget.

- 24. We have designed and sized the support of the enhancements carefully. There is something for everyone, regardless of age, property type, or income.

- 25. But we also do not want to inadvertently stimulate demand too much and push up prices, something which Ms Foo Mee Har cautioned against. So, the support is targeted and tilted towards those with less.

- 26. What will we achieve through the enhancements to the Assurance Package in this Budget? For lower-income households, it will fully cover their increase in spending due to inflation this year. For middle-income households, it will substantially cover the increase in spending due to inflation this year.

- 27. We are not only helping families. We are also helping businesses cope with higher costs, especially SMEs.

- 28. One of the reasons for rising business costs is higher wages for Singaporeans. For example, we are raising the wages for lower-wage workers. I am sure everyone supports this. But it will mean higher costs initially for businesses, especially SMEs. That is why the Government is doing more in this budget to co-fund the increase.

- 29. Similarly, as Senior Minister of State Heng Chee How highlighted, we are raising CPF contributions for older workers so that they have sufficient savings for their retirement. Again, this will lead to higher costs for businesses. But the Government will offset half the increase in employer contributions for 2025.

- 30. We are doing more to help businesses in this Budget through the Enterprise Support Package – this is the most generous Corporate Income Tax rebate we have extended to date. For all eligible firms, including those that are not profitable, we are providing a cash grant. The support can be used to defray cost increases, in wages, rentals, utilities, or transport, depending on the circumstances of each business.

- 31. I understand that some groups will feel that the help extended is still not enough. But I hope everyone can appreciate the bigger picture. We are going through a rough patch of higher prices due to forces well beyond our control. We are not the only country facing these difficulties. The Government will do everything we can to help households and businesses to get through this rough patch. Already, the situation is improving, and it should get better this year.

- 32. But ultimately, the best way to deal with inflation is for businesses and wages to grow in real terms. To achieve that, we need better economic growth.

C. How will we sustain growth and help Singaporeans secure a better future?

- 33. So, this leads me to the second issue – how can we sustain growth and help Singaporeans secure a better future? Many Members spoke up about this, including Ms Jessica Tan, Mr Saktiandi Supaat, Mr Shawn Huang, Mr Sharael Taha, and Mr Vikram Nair, among others.

- 34. Securing economic growth is more than just a statistic – it is about how we stay relevant, add value to the world, and make a living for ourselves.

- 35. The reality is that Singapore will always be a little red dot. We have no hinterland. We have no natural resources, unlike resource-rich countries like Qatar or the UAE. If we falter, no one will come to our rescue.

- 36. Moreover, businesses have so many options when they wish to invest or site their global or regional headquarters and operations. We know that Singapore is not the cheapest location. So, we must work even harder to add value and justify the Singapore premium. This is what we have been continually doing since our independence.

- 37. Our economy today reflects this progress up the value chain. Take the example of an MNE like Siemens. It is one of the few companies that have been in Singapore for more than a century, since 1908. Siemens today has changed many times over from when it started. It has significantly expanded and upgraded its business, from a small sales office to electronics assembly in the 1970s.

- 38. Now, it provides technologies across a range of sectors, including transport systems, water treatment technologies, and medical diagnostic equipment. Last year, it announced that it will establish a new high-tech factory in Singapore, which will employ significant levels of automation and digitalisation.

- 39. Along the way, Siemens has spun off new sub-units, including the semiconductor company Infineon Technologies, which some of you may have heard of. Some of these sub-units have grown into industry leaders in their own right, with their key manufacturing and R&D functions based here in Singapore.

- 40. Sir, there are many other examples like this. MNEs have continued to grow and upgrade their presence here in Singapore because they value our skilled workforce, our infrastructure, and our connectivity to help them better access key markets in the region and beyond. So, when you add it all up, it means that the value-added content of our manufacturing sector has increased. We are able to command better prices in world markets, and this in turn benefits our workers, who are able to enjoy higher wages.

- 41. This is how we are able to stay competitive, despite our higher costs. One way to see this is to look at Singapore’s share of global exports. Since 2010, even while our cost base has gone up, our share of the world’s total goods exports has been maintained at about 2%. Our share of global services exports has increased from 2.5% to 4.1%. We are able to hold our own, maintain our competitiveness and add value to make a living for ourselves and for our workers.

- 42. The question is how do we continue to maintain or even increase our share of global exports in the years to come? The only way is through productivity improvements, something which Deputy Prime Minister Heng emphasised yesterday.

- 43. We aim for 2~3% economic growth per annum over the next decade on average. Of this, about 1~2 percentage points should be from productivity improvements.

- 44. To be clear, this is a very ambitious goal. Only a few countries, at our stage of development, have been able to sustain such high productivity growth. It requires a continual transformation of our economy. Firms need to learn new ways to do business, workers need to learn new skills to contribute differently, and to embrace new technologies. New firms in new sectors must start up and grow, and more than replace the firms in declining industries. As Ms Mariam Jaafar and several Members have noted, this is a massive undertaking – but we are aiming high and we are determined to do our best to achieve this.

- 45. One key strategy is to attract more high-quality investments into Singapore. Because these investments typically involve cutting-edge and innovative activities. They help to push the productivity frontier and that is why we need new investment promotion tools like the Refundable Investment Credit.

- 46. Another strategy is to maintain consistent and steady investments in R&D. And that is why we are making the top-up to RIE2025 in this Budget, which will sustain Government investment in R&D at about 1% of our GDP. This will yield dividends over time.

- 47. Some have voiced concerns about whether we will become a two-track economy – one track for MNEs and another track for SMEs. I can understand these concerns, but it is not so helpful to think of the economy in terms of larger foreign and smaller local companies.

- 48. A better way is to consider the two broad segments of the economy – one that is outward-oriented and another that is domestic-oriented. Every economy, including in Singapore, has these two segments. And each faces different challenges and business conditions.

- 49. The outward-oriented segment of the economy comprises MNEs, but it also has many local enterprises, big and small. Together, they make up about 60% of the firms in Singapore. And there are many supplier and partnership arrangements between MNEs and local firms. We want to encourage more of these partnerships, and we have enhanced the PACT scheme in this Budget to do so.

- 50. Companies in this outward-oriented segment are generally more productive and also have some scale. They have to be. They compete in the global marketplace. They must continuously innovate and up their game. Otherwise, they will fall behind and they will lose their share of the global market.

- 51. Not surprisingly, these companies have high take-up of Government schemes that help them invest in R&D, automation and productivity improvements. They do not need to be persuaded to do so. Everything is at stake for them.

- 52. Given their higher productivity, this outward-oriented segment accounts for about 75% of our economy in terms of nominal value added.

- 53. The remaining 25% of our economy comprises mainly domestic-oriented sectors like F&B, retail, and construction.

- 54. These are more labour-intensive. And there are also domestic services that are high-touch in nature like childcare and elderly care, which require more workers. These domestic-oriented sectors tend to be less productive than the outward-oriented sectors. Now, that is not unique to Singapore – it is the same for all other economies. But the productivity of some of our domestic-oriented sectors lags behind similar sectors in other advanced economies. For example, the productivity of our construction sector is about one-quarter that of Switzerland.

- 55. Of course, within our domestic-oriented sectors, there is a range of firms. Some are embracing change and restructuring themselves to be more productive. Others are less ready to do so. That is why we can and we must do more to encourage and support companies, especially SMEs, in their restructuring journey.

- 56. Several Members spoke on this, including Mr Chong Kee Hiong, Mr Keith Chua, Mr Neil Parekh, Mr Derrick Goh, and Mr Mark Lee, and we will consider all of your suggestions. But we also have to be careful that Government support does not inadvertently prop up outdated or unviable business models, and hinder restructuring.

- 57. That is why our support schemes are geared towards supporting business owners who are themselves prepared to embrace change, and to adopt new and more productive solutions. This is what we have done and will continue to do.

- 58. While we push hard on productivity growth, we also need our workforce to grow. This is one issue that comes up repeatedly in all our engagements with businesses, especially SMEs – they just cannot find enough workers.

- 59. Some of the increase in the workforce will come from growing our resident workforce. But we know that the increase in our own resident workforce has been slowing and will not be sufficient to meet the demands of our economy. So, it will have to be complemented by a continued inflow of foreign work pass holders.

- 60. We already have in place a comprehensive system of controls to regulate the quality and the number of incoming work pass holders. This applies across every level of the workforce.

- 61. At the lower end of the income spectrum, we have Work Permit holders. They comprise about two-thirds of our total foreign workforce, and mostly take up roles that Singaporeans do not want to do, for example, in construction.

- 62. We have not loosened our Work Permit controls. We have no intention to do so. But even at present settings, firms are able to bring in more workers, because of the demand. We are building more public housing, more residential housing projects. We are ramping up and going ahead with major infrastructure projects like the MRT, Changi T5 and Tuas Port. Workers are needed to build these projects, so the firms are bringing in more of them.

- 63. At the same time, we will ensure, as Mr Louis Ng said just now very eloquently, we must make sure that we take care of these workers. So, we will ensure that we have the necessary infrastructure to accommodate these workers well, including building more dormitories, dormitories with the revised standards we have put in place based on our Covid experience, as well as Recreation Centres for their well-being. This is what we owe to the workers who help to build our country.

- 64. At the middle-income levels, we have Singaporeans doing the jobs, but there are not enough of us, and that is why we need to top up with S Pass holders. They include people doing important jobs like nurses and technicians.

- 65. So far, S Pass numbers have been stable. We will continue to make sure that S Pass holders have the right skillsets and are in areas where we need them the most.

- 66. At the higher end of the income spectrum, we have Employment Pass or EP holders. These are professionals with the abilities and skills to contribute at the upper end of the workforce. This is especially so for new growth areas like AI and the digital economy, where there is currently a shortage of skilled talent, not just in Singapore but also globally.

- 67. We apply salary cut-offs to ensure that the EP holders we bring in are of the right calibre. In particular, we have stated previously that we aim for EP holders to be comparable in quality to the top one-third of our local PMET workforce. To keep pace with changes in wages, we will raise the minimum qualifying salary for EP applicants. The Minister for Manpower will share more details of the changes at its Committee of Supply.

- 68. This is not a new policy setting, because the policy intent to ensure that the salary cut-offs are comparable in quality to the top one-third of our local PMET workforce has been earlier stated. That remains the policy intent but because local wages have gone up, we will have to adjust accordingly and the changes will be announced by the Minister for Manpower at its COS.

- 69. So, when you look at all of these different factors over the coming decade, we expect the workforce to grow at about 1% per annum, in line with the needs of the economy. This combined with productivity growth of about 1~2% is how we can achieve 2~3% growth for the overall economy.

- 70. Why are we doing all this? It is not to chase after a target. It is not to grow for the sake of growth. It is to secure better outcomes for Singapore and Singaporeans. That is why in tandem, we are making several other major moves.

- 71. We are introducing new Workplace Fairness Legislation – this reflects the Government’s commitment to push against discrimination in the workplace, and ensure fair employment opportunities for all workers.

- 72. We are investing more heavily in Singaporeans, something which many Members spoke passionately about. This is how we give our people the extra advantage to compete and excel in the global marketplace.

- 73. In particular, in this Budget, we are making significant enhancements to SkillsFuture and introducing new schemes to help our workers realise their full potential, regardless of their start points or stage of career.

- 74. We have focused on the segments that face more challenges. For young ITE graduates, we introduced the ITE Progression Award, to encourage and support their upskilling journey. Mr Xie Yao Quan and Ms Cheryl Chan spoke about this. With this Award, they will be better supported and they will have many opportunities to get an MOE-funded diploma – not just in the Polytechnics, but also at other institutions like ITE, where they offer Work-Study programmes as well as the technical diplomas. We want our ITE students to do well, deepen their skills, and go further, get on a better career and wage trajectory in life. This Progression Award will encourage and support them in this journey.

- 75. For mid-career workers, the new SkillsFuture Level-Up Programme will support them with a substantial injection of skills to improve their employability. Many Members, including Leader of the Opposition Mr Pritam Singh, Associate Professor Jamus Lim, Mr Christopher de Souza, Mr Gerald Giam, Mr Desmond Choo and Dr Syed Harun all spoke about this. There were many suggestions, such as to expand the scope of the SkillsFuture Credit, to reduce the qualifying age, or to provide additional incentives and support. I appreciate the strong support and interest.

- 76. The Level-Up programme is a significant new addition to our SkillsFuture system. Let’s make this move first. We have not even talked about the details yet, which will be announced by the Minister for Education at its Committee of Supply. So, we will make this first move, and we will consider all your feedback and suggestions, and consider how to further fine-tune and enhance the scheme, as we gain more experience over time.

- 77. There is another segment we are paying close attention to: Singaporeans with the potential to take on leadership positions in MNEs. Over time, more Singaporeans have taken on such regional and global leadership roles, and we want to nurture and grow this pipeline of Singaporean leaders.

- 78. Naturally, there is intense competition for these highly sought-after jobs. The MNEs will and should rightfully select and appoint their leaders by merit. But when companies consider people for such roles, they will typically look for those who have already spent substantial time managing an overseas operation. Because remember, they are looking for regional and global leaders. So, you must have spent time overseas, running and managing regional or global operations.

- 79. This means that Singaporeans, who would like to be considered for these positions, must be prepared to be posted overseas, not just in their early 20s when many young people like to be posted overseas, but also in their 30s or 40s, where they are taking on managerial responsibilities, and also when they may have settled down and have families here.

- 80. Understandably, at that season in life, relocating overseas will not be easy. There are many considerations. The spouse may have to stop work for some time. The children will have to adjust to an international school, and then come back to re-adjust to the Singapore system.

- 81. So, we are reviewing this, and considering how we can provide more support for Singaporeans under these circumstances so that we can help support them when they go overseas, when they come back, and put them in a better position to be considered for leadership appointments in their respective companies.

- 82. Over time, I am confident we can develop and nurture more Singaporean experts and leaders across all fields. We have been doing this systematically in Finance for some time already, and we can see the results – we now have around 4,000 Singaporeans holding senior roles in the financial sector, up from fewer than 2,000 in 2016.

- 83. We now have a network of Singaporean finance leaders, who come together regularly, they meet up and they support one another in their leadership journeys. We will redouble our efforts in Finance, and also in other key sectors of the economy.

- 84. These are our plans to secure better growth and better opportunities for all Singaporeans. This is also how we take concrete steps towards helping everyone realise their Singapore Dream.

- 85. This idea of a refreshed Singapore Dream was expressed by the vast majority of Singaporeans, especially our youths, during our Forward Singapore engagements.

- 86. To be clear, it does not mean that Singaporeans have given up on material goals. But they want to avoid getting trapped in an endless rat race of hyper-competition. They want to find meaning and fulfilment in what they do, beyond material success.

- 87. I think these are noble aspirations. There are undoubtedly some generational shifts – because these aspirations are perhaps more commonly expressed among those born after Independence than before.

- 88. My colleagues and I in the 4G leadership, almost all of us were born after Independence too. So perhaps we instinctively empathise with these aspirations, and as part of Forward Singapore, and in this Budget, we are doing more to help our fellow Singaporeans realise these shared aspirations – by providing more opportunities and diverse pathways for everyone to excel, to develop to their fullest potential, and to be the best possible version of themselves.

E. Singapore’s Fiscal System: Fair, Prudent, Sustainable

- 128. Sir, our approach to investing in our people and building our social support system has yielded very good outcomes. Even while we spend only a fraction of what other governments spend.

- 129. Take education, for example. We provide quality education that produces results. We have one of the highest mean scores in Reading, Mathematics and Science in the Programme for International Student Assessment (PISA), as Members are aware. And the results give us confidence that our students are future-ready – PISA does not test rote learning, it tests students’ ability to apply what they have learnt to unfamiliar settings and real-world contexts, and our students do well in these tests. We have achieved all this while keeping education expenditure at about 2% of GDP, which is less than half the OECD average of about 5% of GDP.1

- 130. Our long-term and prudent approach has enabled us to keep Government expenditure at less than one-fifth of GDP. This has in turn allowed us to keep our tax burden low. In fact, 40% of all workers do not pay personal income tax. The effective tax burden for middle-income households at around 10% of household income is significantly lower than other advanced economies. UK and Finland, for instance, have middle-income tax burdens that exceed 30%.

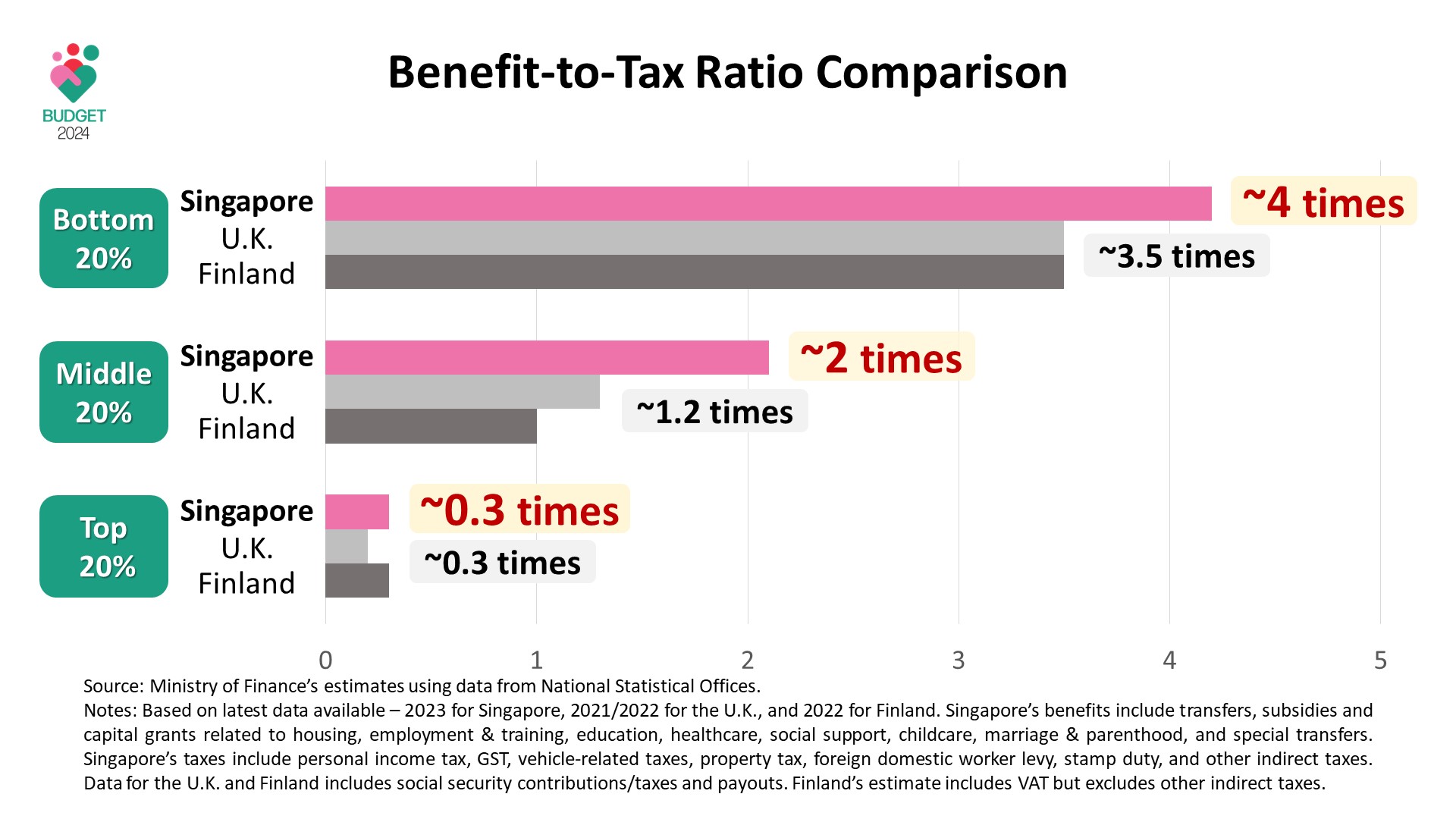

- 131. Our fiscal system is also fair and progressive, where those with greater needs receive more help than what they pay in taxes. The lowest 20% of households receive about four dollars for every dollar of tax paid. The middle 20% of households receive about two dollars for every dollar of taxes. And the top 20% of households receives about 30 cents for every dollar they pay in taxes.

- 132. Members are familiar with these statistics. We have shared them before. They have not changed. How does this compare with other countries?

- 133. While there are inherent limitations in comparing across countries, we have done some computations. Singapore in fact does better than advanced economies like the UK and Finland, especially for lower and middle-income households. The statistics that I mentioned just now also do not include other intangible benefits such as access to world-class education that I mentioned earlier, or having safe streets in Singapore. This is how we provide and take care of our people.

- 134. Of course a progressive system must mean that the better-off contribute more. This includes paying more in Property Tax for those with higher-value homes. With the Annual Value (or AV) band changes, the higher owner-occupied Property Tax rates will apply to those living in homes with AVs above S$40,000, or the top 7% of properties in Singapore. Of course within this group, there is also a range. Those who pay a lot more in Property Taxes generally have homes with much higher value – we are talking about higher-end condominiums, semi-detached houses, bungalows, and Good Class Bungalows. That is what the Property Tax is designed to do – it is a wealth tax for those with more assets.

- 135. But we do recognise that there are some groups, especially seniors and retirees, who may need some support to cushion the impact of the Property Tax increase, and this was highlighted by several Members including Ms Joan Pereira, Mr Lim Biow Chuan, and Mr Yip Hon Weng. Beyond the 24-month interest-free instalment plan, which I have announced in the Budget, those who face difficulties in paying, especially retirees and seniors, can approach IRAS for assistance.

- 136. Next, let me deal with some specific questions on tax changes.

- 137. Ms Usha Chandradas asked about the withdrawal of the tax concession on royalty income accorded to authors, composers and choreographers. This concession was introduced in 1983 as she highlighted, at a time when Personal Income Tax rates were much higher. Since then, tax rates have come down. The concession now currently benefits only a very small group of taxpayers. We have decided to withdraw the concession to ensure parity in the treatment of royalty income with other sectors. At the same time, we are putting in much more resources to provide additional broad-based support for the arts sector. So, we are not withdrawing resources from the arts sector, we are putting in more resources for the arts sector.

- 138. There were other tax-related suggestions from Ms Usha and other MPs, including Mr Don Wee, Mr Edward Chia, and Ms Denise Phua. I thank Members for the suggestions. We will continue to review them, taking into consideration their relevance for our tax regime, costs and benefits, and of course, consistency with international standards.

- 139. Some Members, Mr Liang Eng Hwa, Mr Louis Chua, and Mr Pritam Singh have sought clarifications on the potential revenue impact from the BEPS Pillar Two moves.

- 140. The OECD’s estimates imply that investment hubs could see a Corporate Income Tax revenue gain ranging from about 17% to 38% – this translates to a revenue gain of about S$5 to S$11 billion per year for Singapore. This is based on OECD’s estimates. But these estimates have not taken into account how MNEs may respond, and the possibility of their activities moving out of Singapore, thereby reducing our tax base. Possibly for this reason, Hong Kong and Switzerland, which are also investment hubs, have estimated their revenue gains at S$1.7 billion to S$2.4 billion respectively, much lower than what the OECD has put out. These data points are suggestive of what the range for Singapore could be - anywhere from around S$2 billion to S$11 billion.

- 141. But we are really not sure where we will end up, because there are so many unknowns. I think no one is sure, to be clear. The OECD has also made very clear these are estimates. No one can be sure what the actual impact can be. What we are doing is to engage the MNEs better, to understand how they are likely to respond, and we will certainly provide our own revenue estimates in due course. In any case, any revenue impact from the Pillar Two moves will only materialise from FY2027.

- 142. So, this is not something for this financial year. We are doing the assessments, we are doing the detailed projections, and we will come back with the detailed revenue estimates. The actual amount of revenue gain and how long it will last depend on how the competitive landscape evolves, and also how much we have to re-invest into the economy.

- 143. Several Members said that the whole point of BEPS is to tilt the playing field in favour of governments and make MNEs pay more taxes. I think Mr Louis Chua and Associate Professor Jamus Lim highlighted that. I agree. That is the intent of BEPS. But there is theory and there is reality. What is the reality? The reality is that MNEs have bargaining power, and governments around the world are all finding ways to favour them and getting them to invest.

- 144. You can read this for yourself. They are not doing this quietly. They are doing this publicly. It is in the media.

- 145. Just a few days ago, Japan said that it would give leading chipmaker Taiwan Semiconductor Manufacturing Company (or TSMC) up to S$6.5 billion more in subsidies for a second plant, and that will bring the total subsidies to TSMC to over S$9 billion. Earlier this month, the US also announced a S$2 billion grant to GlobalFoundries, the largest grant from the CHIPS Act to date. These are very generous subsidies that the major economies are giving to MNEs. We are not in the same league, but we have to play a smart game so as not to lose ground and to anchor important investments here.

- 146. This is why we introduced the Refundable Investment Credit in the Budget to update our investment promotion toolkit, and committed to spending more to support new investment, research and innovation activities.

- 147. These moves are absolutely necessary – so that we remain in the race for quality investments, and create good jobs for Singaporeans. This is not an academic exercise. This is about the lives and livelihoods of Singaporeans. We will do whatever is necessary to safeguard this, especially in a world where competition will only get tougher. So let us not be so naïve to think that the putative gains from BEPS will simply materialise in our favour.

- 148. This is why, as I said in my Budget statement, after taking into account these additional expenditures that we are likely to incur, I do not expect the Pillar Two move to generate significant additional net revenues on a sustained basis.

- 149. I should also add that the above estimates do not take into account the impact of Pillar One, because all that we have been talking about is Pillar Two. But Pillar One has been delayed, and if it is implemented, it will clearly be revenue-negative for Singapore.

- 150. After taking into account all this, what is our fiscal position?

- 151. Last year, MOF published an Occasional Paper on our medium-term fiscal outlook, up to FY2030. We showed that our spending needs would grow as a percentage of the GDP, to support our ageing population and expand and strengthen our social safety nets, and there would be a funding gap of more than 1% of GDP if we did nothing. But with the tax measures announced in the last two Budgets, including the GST rate increase, we project that we could close the funding gap, provided we manage the pace of spending growth. All that was in the Occasional Paper, and that is indeed what we have done.

- 152. Tax changes have come into effect, although we have not yet experienced the full revenue impact, because we have given some rebates. We also enjoyed some revenue upsides. Some are due to sentiment-driven revenues like Stamp Duty and Vehicle Quota Premiums, and stronger than expected Corporate Income Tax Revenues last year from a strong rebound amongst some companies post-Covid.

- 153. So, overall, we are currently in a sound fiscal position. And we are putting our resources to good use – to address immediate concerns and also upcoming needs.

- 154. This is no different from how one would manage one’s own personal finances. Imagine if you are a home-owner planning for a major renovation in five years’ time. What do you do? You start setting aside resources for this now, for the major expenditure in future. You do not wait until renovation starts before you look for the money, and hope that it is there somehow.

- 155. In the same way, we have set up Funds to meet real commitments, and real spending needs. Some of it are for recurring commitments, such as the permanent GST Voucher scheme, which we draw on year after year; for new commitments like the Majulah Package; and for major spending needs that are coming up, like the Future Energy Fund, which will help to decarbonise our energy system.

- 156. Some other countries operate differently. There are countries that make major commitments without assurance of funding. In the US they call these “unfunded mandates” – pass laws for all sorts of provisions, but find the money later. Let’s not worry about money now. That is not how we do things in Singapore. If this Government makes a commitment, we make sure it is properly funded. We make sure we deliver on our promises.

- 157. But let us also be clear. The days of structural fiscal surpluses in Singapore are over. If you look at our economic and fiscal situation, growth will come down. We hope to achieve 2-3%. Operating revenues will barely keep up with GDP growth. Net Investment Returns Contribution (or NIRC) will also broadly maintain as a share of GDP over the medium term.

- 158. Expected long-term returns are about 4%. This is updated every year. We go through a rigorous process to do so, with the Council of Presidential Advisers (CPA) and the President. But we do not expect this to increase, given the more challenging investment environment. The expected returns are applied on the reserves or the net asset base, and we take half of that to generate the NIRC. If we really had so much surpluses, somehow streaming into the reserves, then the net asset base must be growing, and the NIRC would be rising significantly as a share of GDP – but it has not, and we do not expect it to do so in the coming years as well. So operating revenues and NIRC maintaining as a share of GDP only means that we must manage our expenditures well. Only then can we continue running balanced budgets till the end of this decade.

- 159. This is also why we do not look at the Budget simply as a one-year plan, but also a multi-year commitment. It is in this spirit that we have provided a preliminary high-level estimate of S$40 billion to resource the upcoming Forward Singapore policy moves.

- 160. The Forward Singapore report has already outlined the broad range of policy areas we are reviewing and studying. Some have been announced, details have been given out in this Budget, others will be fleshed out in due course, as will the detailed fiscal requirements of these subsequent moves. We will also update our medium-term expenditure and revenue projections. The Occasional Paper that we had published last year may not be so occasional after all. We will keep updating it, so that everyone will have a sense of how our fiscal trends are unfolding, not just on a year-to-year basis, but over a five- to ten-year horizon.

- 161. We must continue to plan ahead, do our sums carefully, and be upfront with Singaporeans on the costs of various proposals. This approach of looking and planning ahead is a hallmark of our fiscal policy. It ensures that we are able to meet our collective aspirations and seize every opportunity that comes our way.

- 162. Perhaps the Opposition takes a different view of fiscal management. Certainly, they want the Government to use more of the reserves for current spending. They suggest different ways of doing so – using revenue from land sales, waiving land cost for HDB flats, increasing the percentage of Net Investment Returns (NIR) that can be spent and so on – but in the end, they all come down to the same thing, which is to use more of the reserves today.

- 163. What will this mean? Basically, we will end up with less for ourselves in the future, and we will also leave less behind for our children and the next generation. Eventually, the NIRC will shrink as a percentage of GDP. The funding gap will increase. And our children will pay more in taxes.

- 164. In fact, this is what many governments in advanced economies are faced with. Their deficits are rising, their debts are rising, and their fiscal systems are at risk of breaking. Many of them have some version of an independent budget office. It has not helped at all. Basically, no political party in these countries are prepared to dish out the hard truths. So, their policy debates are dominated by what some commentators call “fiscal fantasies”. What are some of these fantasies? They include far-too-optimistic forecasting assumptions; the idea that all the funds can be raised from the rich with close to zero consequences for the rest of the population; or that they can kick the fiscal can down the road indefinitely – just continue to spend, and leave it to their children or to those not yet born to solve the problems.

- 165. Let’s not indulge in fantasy thinking. Not in this House, not in Singapore. Having the resources to pursue a strong economy and a strong society, and achieve good outcomes, is not a fairy tale. This is very much our Singapore reality, but it requires us to focus on prudence, fairness and sustainability.

- 166. What we have is a unique and certainly, a privileged position of strength. Many economies pay about 2% of their GDP in debt servicing for debts that had been accumulated. We are different. We enjoy the benefits from savings from the past. To continue on a sustainable path, we must maintain our commitment to set aside enough not just for ourselves but also for the future.

- 167. I call on everyone in this House – let’s commit to upholding these values – fiscal responsibility, discipline. Ensure that our fiscal system meets the needs and aspirations of both current and future generations of Singaporeans.

- 168. If the Opposition parties have a different view on this, I invite them to take up the challenge the Prime Minister issued in this House a few weeks ago: Make drawing more from the reserves an election issue. Go to the people, ask them for a mandate to change the Constitution, compel the President to let you spend 60%, 75% or even 100% of the NIR. The PAP will join issue with you – we will present our case to Singaporeans, and ultimately Singaporeans can decide what is the best fiscal approach to take Singapore forward.

F. Conclusion

- 169. Mr Speaker Sir, Singapore is at a critical moment of change. We are entering a different world – one that is messier, more dangerous, and more unpredictable. There will be more forces that threaten to pull us apart.

- 170. This year’s Budget is the first step in advancing our Forward Singapore agenda. We want to refresh our social compact to keep our society strong and united in this troubled world. We want to build a better Singapore – not just for a few, but for all Singaporeans. We want to refresh the Singapore Dream, and build a Singapore that is vibrant and inclusive, fair and thriving, resilient and united.

- 171. The road ahead to this better Singapore will not be easy. But we are all in this together, and we all have a part to play. The Government will do more to provide opportunities and assurances at every stage of life, and everyone in society should contribute towards our shared goals and aspirations in our own ways.

- 172. I take heart from the nation-building journey we have had so far. As one united people, we have consistently turned our challenges into opportunities, and our constraints into strengths. We have done it before, and I am confident we will do it again.

- 173. Sir, let us build our shared future together.

Footnotes

1 Source: Education at a Glance 2023, OECD Indicators, Table C2.1 – Total expenditure on educational institutions as a percentage of GDP (2020).