What are Singapore's reserves?

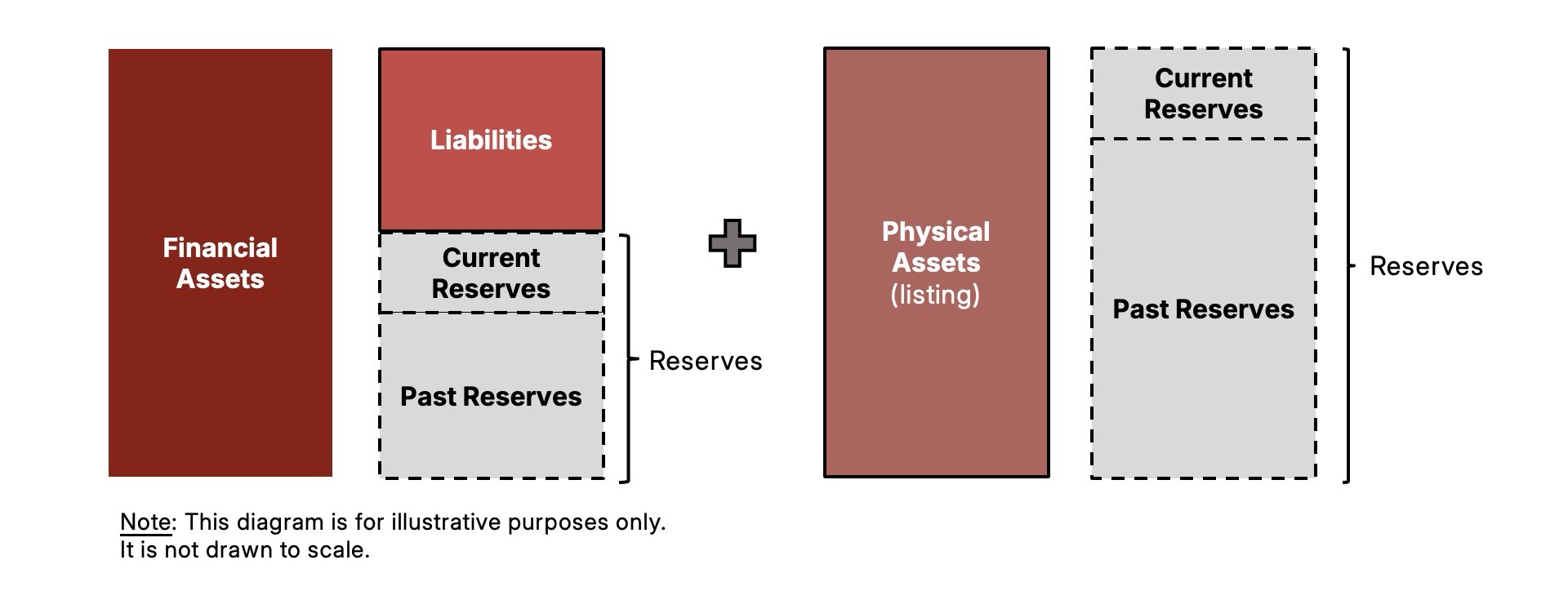

Singapore's reserves refer to the total assets minus liabilities of the Government and other entities specified in the Fifth Schedule under the Constitution.

On this page

What are Singapore's reserves?

The reserves refer to the total assets minus liabilities of the Government and other entities specified in the Fifth Schedule under the Constitution. These Fifth Schedule entities include key statutory boards and Government companies, namely JTC, CPF Board, MAS, HDB, GIC and Temasek.

Government's assets include:

Physical assets like State land and buildings;

Financial assets like cash, securities and bonds.

Government's liabilities include:

Singapore Government Securities (SGS), which are issued for the purposes of developing our domestic debt market and providing a risk-free benchmark against which other risky market instruments are priced off.

Special Singapore Government Securities (SSGS), which are Government bonds issued to the CPF Board. CPF monies are invested in these special securities which are fully guaranteed by the Government. The securities earn for the CPF Board a coupon rate that is pegged to CPF interest rates that members receive.

What does the Constitution protect?

Past Reserves are protected by the Constitution for the benefit of current and future generations. The President’s concurrence is needed before the Government can draw on Past Reserves.

Past Reserves refers to the reserves accumulated during previous terms of Government. To prevent reckless spending by a Government that could result in a draw on Past Reserves, the Constitution protects the Past Reserves of the Government and Fifth Schedule entities. The Past Reserves of each entity are separately protected for clear accountability.

What is a draw on Past Reserves?

A draw on Past Reserves can occur in several ways. For example:

The Government or a Fifth Schedule entity spends more than the reserves it has accumulated during the current term of Government.

An asset (e.g. State land) is sold below its fair market value and the difference is not topped up from Current Reserves – i.e., the reserves that were accumulated in the current term of Government. Fair market value of an asset is the price that it would fetch in a free and open market, between a willing buyer and willing seller.

When the country faces severe challenges or crises, leading to the need to draw on Past Reserves with President's concurrence (e.g. during the Covid-19 pandemic and Global Financial Crisis). The Constitutional safeguard ensures that Past Reserves are used prudently under exceptional circumstances and crises. .

What is the size of the reserves?

It is not in our national interest to publish the full size of our reserves. Our reserves are a strategic asset, and especially so for a small country with no natural resources. Our reserves serve as a financial anchor and provides support in times of crisis, such that Singapore can mount a strong response without compromising essential services and incurring debt.

MAS and Temasek publish the size of the funds they manage. As of 31 March 2025, the Official Foreign Reserves managed by MAS was S$514 billion and the size of Temasek's net portfolio value was S$434 billion. Though it is known that GIC manages well over US$100 billion, the full amount is not disclosed to the public.

Revealing the exact size of assets that GIC manages will, taken together with the published assets of MAS and Temasek, amount to publishing the full size of Singapore's financial reserves. As the reserves are akin to Singapore’s war chest, it is not in Singapore's strategic interests to reveal exactly how much we have.

How does the Government remain accountable for its fiscal management?

The Government is accountable to Parliament for its spending.

The Government's accounts are also subject to independent audits by the Auditor-General's Office (AGO)1. The Public Accounts Committee reviews AGO's reports, and can call on the relevant agencies to explain lapses or take corrective actions.

Under the current "Two-Key" system, the President and the Council of Presidential Advisors have full access to information on the reserves, and they play a critical role in safeguarding Past Reserves.

[1] The position of the Auditor-General is safeguarded under the Constitution – i.e., the appointment and removal of the Auditor-General is subject to President's concurrence. This ensures the Auditor-General is able to carry out his duties without fear or favour.

What happens to the reserves when there is a changeover of the term of Government after a General Election?

In a financial year (FY) with a changeover, the Overall Fiscal Position of the FY is apportioned between the outgoing and incoming terms of Government, to enable the proper functioning of public operations in both terms.

Any surpluses of the outgoing term of Government will be added to Past Reserves at changeover, which will only be known after the changeover and the end of the FY.

We do not disclose the amount each term of Government has protected as Past Reserves, nor the amount accrued to the incoming term of Government, as this could allow speculators to arrive at a more accurate estimate of the full size of our reserves over time.

Understand more

Government Financial Statements

The Statement of Assets and Liabilities are submitted to Parliament at the end of each financial year in accordance with the Constitution.

Our assets and liabilities

Learn about the Official Foreign Reserves, Reserves Management Government Securities and Government Borrowing.

Net Investment Returns Contribution

The Net Investment Returns Contribution (NIRC) allows the Government to spend up to 50% of expected returns on reserves, supporting sustainable budgets.

Learn more about our reserves

SM Lee Hsien Loong shares what the reserves mean for Singapore.

![Thumbnail for [CNA Exclusive] PM Lee on reserves as a secret weapon - Pt 2/3 | Singapore Reserves Revealed](https://i.ytimg.com/vi/BKGU8ekFmRQ/hqdefault.jpg)